NOTE: The worksheet was updated 5/12 to replace projections for 2008-09 with actual tax levy data.

The State Commission on Property Tax Relief is expected to release a proposal for a property tax cap on May 22, 2008.

The State Commission on Property Tax Relief is expected to release a proposal for a property tax cap on May 22, 2008.

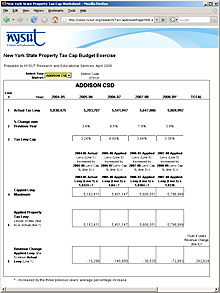

To demonstrate the impact of a property tax cap on school district revenues, the NYSUT Research and Educational Services Department has developed an online worksheet to estimate the cumulative impact in your school district if a tax cap had been implemented in 2005.

The worksheet assumes the cap for each year would be the lesser of 120% of the Consumer Price Index or 4%; this is the current standard for developing a contingency budget. Here are the projected caps for the 4 years:

-

2005-06: 3.24%

-

2006-07: 4.00%

-

2007-08: 3.84%

-

2008-09: 3.36%

Statewide, the estimated impact of a tax cap over the last four years would be a revenue loss to school districts of $1,279,559,374.

In order to find the impact for your district, use the drop down list included in the worksheet.

Pass it on!

We encourage you to use this information to educate your community members and elected officials on the impact of the cap on your school district. Send them to www.nysut.org/taxcapworksheet .