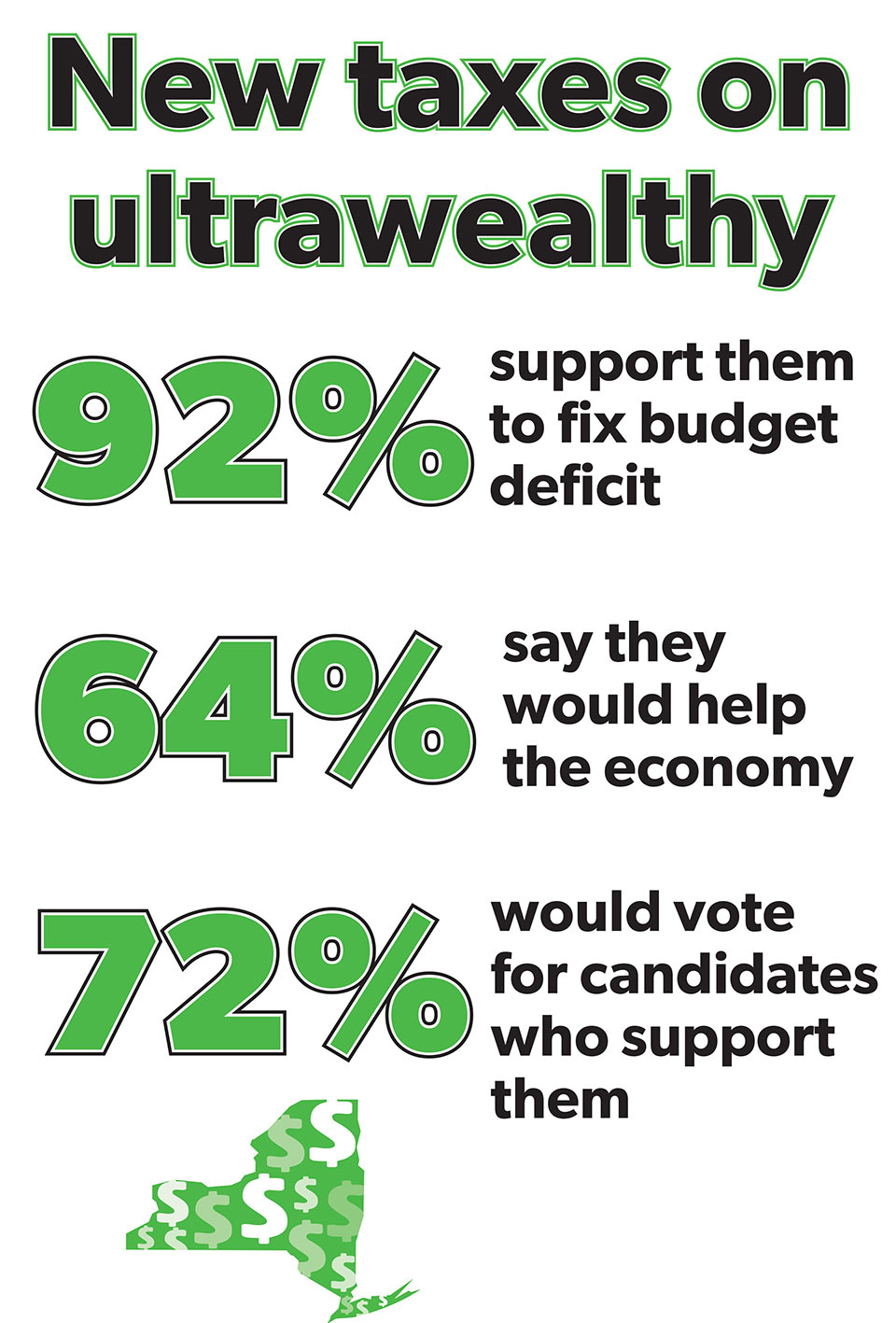

Union activists, lawmakers and members of the media sardined into the press room of the Legislative Office Building in Albany today to hear the results of a recent poll that showed 92 percent of New York voters support new taxes on the ultrawealthy as the state grapples with a reported $6.1 billion budget deficit.

NYSUT President Andy Pallotta, Executive Vice President Jolene DiBrango, Secretary-Treasurer J. Philippe Abraham, President Fred Kowal of United University Professions and Secretary Nivedita Majumdar of the Professional Staff Congress, were surrounded by leaders of other unions and numerous elected officials.

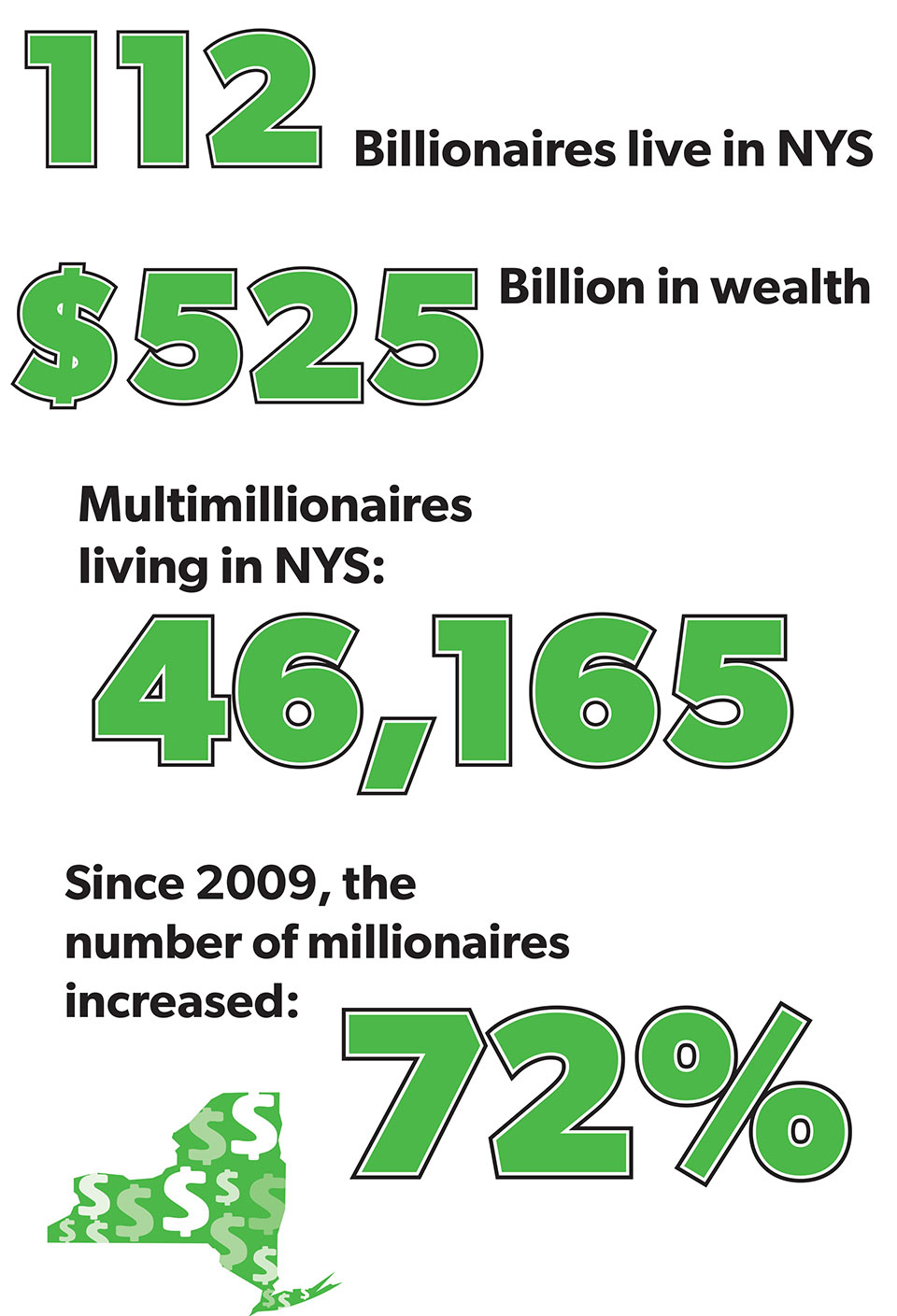

Pallotta said there is plenty of untapped revenue available in the state. With 112 New York billionaires sitting on $525 billion in wealth and more than 46,000 multimillionaires in the state, the unions said new tax proposals would generate $12 billion in revenue.

Some lawmakers say it’s hard to raise taxes in an election year, Pallotta said, “but I’ll tell you what’s hard: It’s hard for overcrowded schools to go without social workers, classroom technology and supplies, and it’s hard for hospitals to go without sufficient staffing.”

“To ensure quality health care, public education and public services, tax revenue must be strategically generated from those who can most afford it,” said Kowal, whose union represents academic and professional faculty on SUNY four-year campuses. “All New Yorkers need to pay their fair share for New York to make real progress.”

The PSC’s Majumdar said her union at CUNY demands that the Legislature make full funding a priority. She called on lawmakers to “refuse to pass a budget unless it includes new revenue from progressive taxation and covers CUNY’s basic operating costs — without raising tuition.”

Citing anti-tax critics of the progressive tax proposal, news reporters asked if the approach would drive ultra-wealthy residents out of the state.

“I’ll say, baloney!” Pallotta said.

“We know that’s not true,” said Ron Deutsch of the Fiscal Policy Institute. “From 2009, when the tax surcharge on millionaires was first enacted, to 2016, the number of millionaires in New York grew by 72 percent. They are not leaving.

“They are here because they want to be here,” he said. “Even if these taxes are enacted, billionaires are still going to be billionaires and they will still have more expendable income than they could possibly use.”

“Let’s get this done,” said Scott Stringer, New York City comptroller and a former state legislator, who recalled fighting for similar solutions two decades ago. “Let’s save the kids in our cities and towns, and let’s make New York the progressive state it is supposed to be.”

Sen. Jessica Ramos, D-Queens, said, “My generation doesn’t have time” to fight for another 20 years.

“My generation can’t succeed while home-purchasing power is down, student loan debt is up, rent costs are up and wages are stagnant and low,” she said. “We won’t be able to survive in New York if we don’t get the wealthy to pay their fair share in taxes.”