Download complete bulletin. (90k pdf)

As required by law, each year prior to the school budget vote all districts must submit a Property Tax Report Card to the State Education Department. The data contained in the 2012 Property Tax Report Card compares the 2011-12 school budget with the 2012-13 proposed school budget and the 2011-12 tax levy with the 2012-13 projected tax levy.

In total, 669 school districts have submitted their 2012 Property Tax Report Card. The Big Five City school districts are not covered by this requirement as the residents in these districts do not vote on their school budget. In addition to the spending and tax levy increases, districts are also required to report three parts of the fund balance on the Property Tax Report Card: (1) the amount and percent of the unrestricted, fund balance, (2) the restricted fund balance and (3) the appropriated fund balance.

For the first time this year, school districts also reported information associated with the new property tax levy cap. Among other data elements, districts were required to submit their 2012-13 Maximum Tax Levy Limit (with exclusions)—this figure represents the maximum tax levy allowed without needing a super-majority vote (60%) for approval. Statewide, there are 51 school districts that are proposing a 2012-13 property tax levy that exceeds their maximum tax levy limit, meaning these districts must get at least 60% voter approval for their budget to be adopted.

The compilation of this information is available on the State Education Department's website at http://www.p12.nysed.gov/mgtserv/propertytax/.

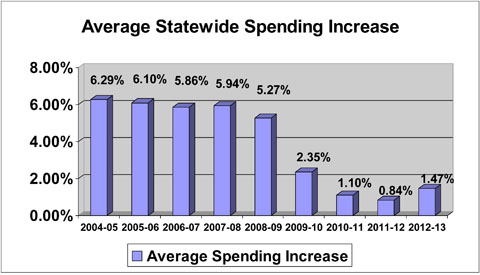

SPENDING —

According to the data contained in the 669 Property Tax Report Cards, school districts on average are proposing budgets for 2012-13 that contain a spending increase of just 1.47%.

Last year, the average statewide spending increase that districts presented in their 2011-12 school budgets was 0.84%, representing one of the smallest increases ever. Voters will decide the fate of their 2012-13 school budget on May 15th.

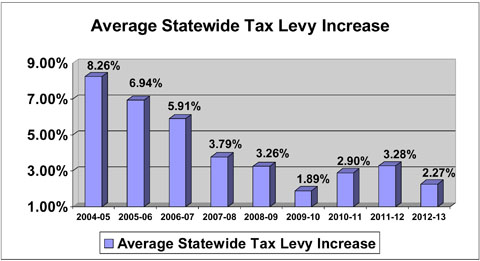

TAXES —

The Property Tax Report Cards also reveal that the average tax levy increase contained in the proposed 2012-13 school budgets is 2.27%. Undoubtedly, the average increase in the tax levy is larger than the average increase in spending because, despite the $805 million increase in state aid this year, school districts are still recovering from the enacted cut of $1.3 billion in state aid to education in the 2011-12 school year. School districts derive their revenue from two main sources—state aid and property taxes. Furthermore, many school districts used their Federal Education Jobs Fund during the 2011-12 school year. The loss of these funds impact the need for additional property taxes to replace these funds.

Download complete bulletin. (90k pdf)

BKB/jd/89078