Union leaders are pressing the state to return to a more progressive income tax model, requiring those who earn more to pay their fair share.

And as the state faces a more than $15 billion deficit, recent polls show New York taxpayers agree.

More than 400 union members brought that message to Albany at a special lobby day Feb. 3 to address the state's current budget crisis.

"For too long, New York's working families have shouldered a disproportionate share of the tax burden, while the most affluent have seen their incomes skyrocket and their income taxes shrink," said NYSUT President Dick Iannuzzi. "In this difficult economy, the answer is not to ask those with the least to do even more."

Under current New York state tax policy, a family making just over $40,000 a year pays the same personal income tax rate as a family making $400,000, or even $4 million.

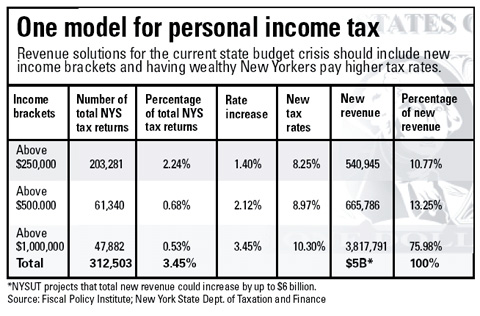

The statewide union is part of several coalitions urging the governor and Legislature to raise the income tax on New Yorkers who earn more than $250,000 a year.

"A reasonable increase in the personal income tax would generate up to $6 billion annually - money that could be used to avoid cuts to education and health care and keep property tax increases to a minimum," NYSUT Executive Vice President Alan Lubin said. Those funds would also help build longterm fiscal stability, he said.

Taxing inequity

Since 1972, New York state has cut its top personal income tax rate by more than 50 percent - from 15.375 percent to 6.85 percent, with single taxpayers entering the top bracket once their income reaches $20,000.

In fact, while the wealthiest 1 percent of New Yorkers take home more than 28 percent of all income - much higher than the national average wealth distribution - 14 states have a higher top tax rate and 21 states have higher income brackets.

California and New York, which both face deficits this year of more than $15 billion, have drastically reduced the income tax rate on the wealthiest since the 1990s.

California's highest tax rate for individuals earning over $44,815 is 9.3 percent. The state does add an additional 1 percent tax to income over $1 million.

Proponents of increasing personal income tax on the wealthiest point to the unfairness of the current system, which subsidizes tax relief for the very wealthy by overtaxing everyone else.

Although many working families are struggling to maintain their incomes, pay mortgages and cope with rising property taxes, the wealthiest New Yorkers have enjoyed unprecedented income growth.

James Parrot, deputy director and chief economist for the Fiscal Policy Institute, noted in a recent Albany Times Union op-ed that while 95 percent of New Yorkers experienced no income growth since 2002, the wealthiest 5 percent of New Yorkers doubled their income.

"This picture is particularly curious because, when it comes to tightening our belts in the recession, the governor's budget has all of the tightening done by the 95 percent, sparing the 1 in 20 at the very top of New York's economic pyramid."

According to the Washington-based Institute on Taxation and Economic Policy, a non-profit, non-partisan research and education organization, the richest 1 percent of New Yorkers took home 28.7 percent of the total adjusted gross income for the state in 2006.

Assuming a statewide federal AGI of $100 million, for example, the wealthiest 1 percent shared $28.7 million while the bottom 50 percent of all New Yorkers split just over $10 million, or 10.7 percent.

Working families are disproportionately affected by cuts in government services, including education and health care, and higher education tuition increases, all elements of the executive budget proposal, Lubin said.

Several new taxes and fees floated in the proposal would also impact low- and middle-class families.

NYSUT - and more than 100 economists from across the state - have called for an equitable income tax that shifts more of the burden to those who can most afford to pay.

"Restructuring the state income tax would actually reduce the tax burden for lower-income and middle-class families while ensuring everyone pays their fair share," Lubin said. "Change is long overdue."

$6 billion solution

According to the Fiscal Policy Institute, tax cuts enacted since 1994 are reducing state revenues by more than $20 billion annually.

While opponents claim raising taxes on the wealthy will drive higher earners out of state, history shows otherwise. Lawmakers have periodically increased taxes on the wealthiest to raise revenues, most recently from 2003–05.

One proposal being floated by the Fiscal Policy Institute and New Yorkers for Fiscal Fairness would increase the tax rate on the wealthiest from 1 percent to 5 percent on income above $250,000.

Economists estimate restoring progressivity to New York's tax brackets could add up to $6 billion to the state's coffers.

Such a plan has broad support. A recent Siena Research Institute poll found nearly two-thirds of New York voters support a personal tax increase on those earning more than $250,000 annually.

Meanwhile, a poll by Quinnipiac University found 80 percent of New York voters support a tax increase on those earning more than $1 million annually, while 73 percent support a tax increase on those earning more than $500,000 per year.

- Clarisse Butler Banks