Testimony of Andrew Pallotta, Executive Vice President, New York State United Teachers, to the Senate Finance Committee and Assembly Ways and Means Committee Chairman DeFrancisco and Chairman Farrell on the Education Budget for Elementary and Secondary Education, January 29, 2013

My name is Andy Pallotta, Executive Vice President of NYSUT (New York State United Teachers). NYSUT is a statewide union representing more than 600,000 members. Our members are pre-k to 12th grade teachers, school related professionals, higher education faculty, and other professionals in education and health care.

I'd like to thank the chairs of the Joint Fiscal Committees and the Chairs of the Assembly and Senate Education Committees for the opportunity to address you today regarding the Governor's proposed budget for elementary and secondary education.

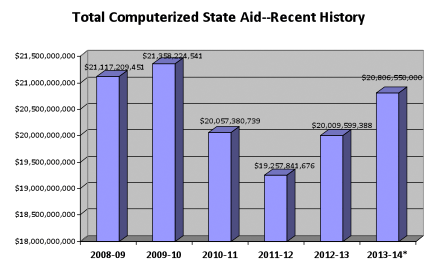

I would like to start by thanking the Executive for providing a good starting point for the school aid negotiations and recognizing the need to provide additional funding above the amount generated under the state aid cap. However, funding in the Governor's Budget for schools is still too little in order to prevent more classroom cuts. To put this into perspective, school funding proposed for the 2013-14 school year is still over half a billion LESS than was provided in 2009-10.

Two years of sizable state aid cuts, coupled with the imposition of the tax cap, have worked together to create conditions where school districts are unable to even maintain their existing educational programs, let alone bring back programs that were cut during the two difficult years of cuts.

Last year although state aid was increased, schools were still forced to cut more than 5,000 educator jobs. Over the course of the last four years, we have lost 35,000 educator positions in New York's schools. That amounts to over 10 percent of the entire teaching workforce and 35,000 less adults in our classrooms helping children learn.

This year's increase is similar, and will likely have a similar result. Unless the Legislature acts to restore more money to our schools, this will be the fourth consecutive year that our schools will have to make devastating classroom cuts. These cuts impact ALL school districts. The overwhelming majority of districts are facing choices that will potentially devastate educational programs across the state.

New Initiatives

The Governor deserves credit for highlighting important initiatives that have the potential to help close the achievement gap in NY and are responsive to worthy recommendations prepared by the Governor's Education Commission.

Full Day Pre-K -- $25 Million

There is overwhelming evidence that quality full day pre-k opportunities lead to better outcomes in terms of the academic and social development of children. Studies show that these programs increase graduation rates, reduce retention in grades, increase reading and math proficiency, and increase college participation and completion. The social and economic benefits are also striking. Quality pre-k experiences significantly reduce juvenile arrests and lowers criminal activity in the later years. It reduces teen pregnancy and results in healthier lifestyles. Numerous studies show that lifetime earnings are increased significantly. In short, the return on investment in pre-k is enormous and has been estimated to be between $12-$14 in economic benefit for every dollar invested.

I know from personal experience as a teacher in an elementary school that you could readily determine which kids had come from a good pre-k program. They were simply more school ready at a time when kindergarteners are already expected to have basic literacy skills such as knowing their letters and numbers. It is far more cost effective and educationally sound to invest in school readiness at the front end rather than playing catch-up only after a student experiences failure and frustration.

This proposal builds on the phase-in of universal pre-k that was spearheaded by Assembly Speaker Sheldon Silver and now serves over 100,000 four-year olds.

Extended Learning Time -- $20 Million

Given the modest investment of $20 million in extended learning, it is essential that this initiative take a targeted approach that meets the learning needs of students who are at greatest risk of failing to meet grade level learning standards and graduation requirements.

We need to customize the approach by grade cluster and subject and should involve all stakeholders in its design. An extended learning program also must be grounded in a comprehensive student-focused curriculum design. Most importantly, teachers and school leaders need to plan for the extra learning time and receive continuous professional development to implement a comprehensive curriculum based approach. Enrichment activities such as music and art must be included in order to motivate students to spend more time in school and provide the well-rounded education they need and deserve.

An example of an effective extended learning approach was part of the "Chancellors District" established by Chancellor Rudy Crew. The extra time was negotiated with the UFT and ensured the necessary curriculum investment, stakeholder planning, on-site professional development, and literacy rich materials to support an effective use of additional learning time. The Rochester Teachers Association is participating in a Ford Foundation extended learning time initiative that also ensures that we are qualitatively improving what we do with additional learning time.

Community Schools-- $15 Million

Failure to meet the social, developmental and health, recreational, and family support, needs of a child often has a devastating effect on that child's learning. The delivery of social, health and family services is often fragmented and ill-coordinated. We applaud the governor for recognizing that schools are more than an academic setting and responding to the recommendations of his Education Commission. Investing in a Community Schools approach will build coordinated community support to optimize services for children.

Reward High Performing Teachers-- $11 Million

The Executive Budget included an $11 million appropriation to reward high performing teachers who will be provided annual stipends of $15,000 to those identified as "master teachers". These programs will include enhancing professional development and utilizing these teachers to train other teachers.

NYSUT believes that professional pay is an integral part of an educational system that promotes professional quality. NYSUT also supports funding for programs to recruit and retain qualified staff including funding for additional pay for expanded roles, school-based incentives and additional credentials. The addition of funding for educators to move up their career ladder and incentives for additional responsibilities for educators who agree to mentor other teachers or agree to teach in high-need schools is necessary but it must be implemented and collectively bargained on the local level.

NYSUT has always recognized the need to provide rigorous pre-service instruction connected to meaningful clinical teaching experiences. We also have long known that every step in developing and retaining highly qualified teachers must be addressed, together. That means, improving how we recruit teachers, mentor and support them in their critical first years, and provide on-going professional development.

Nationally, 47% of teachers leave by the fifth year of teaching. This represents a colossal waste of human resources.

"Bar Exam" for Teachers

The Executive proposes to increase standards for teacher certification by requiring passage of a "bar exam" – a proposal developed by American Federation of Teachers President Randi Weingarten.

If structured correctly and connected to quality pre-service education, a rigorous "bar exam" for teachers could elevate the profession and give it the respect it deserves.

But simply accreting another exam to the three exams we already have is not going to work. Any new exam must be part of an integrated and comprehensive improvement of pre-service instruction, induction, and support in order to attract and retain promising new teachers.

School Aid

NYSUT members are doing everything they can to provide the services students need - finding cost-savings and economies of scale and dealing with the impact of layoffs and position losses. NYSUT and our locals have made it clear, we are willing to work locally and at the state level to preserve essential services. NYSUT believes that, particularly in these troubling economic times, investing in education makes both good fiscal sense and good public policy. Funding targeted to quality public schools will see the greatest return on taxpayer money and will strengthen the entire economy.

New York's schools are still reeling from the multiple years of school aid cuts imposed upon them. These cuts have caused class-sizes to balloon, decimated course offerings and after school programs, particularly music, art, physical education, curtailed academic support for at risk children, eliminated counseling services, and rolled back early childhood programs including full day kindergarten and pre-K.

The Executive budget provides an increase of $889 million or 4.4 percent, for the 2013-14 school year. Out of this $889 million, $125 million is competitive grants, and another $203 million is for a one time Fiscal Stabilization Fund that has yet to be allocated. While the competitive grants are generally set aside for commendable purposes, this is not funding that school districts across the board can count on to support their educational program.

Additionally, the $203 million proposed for Fiscal Stabilization is a one-time infusion of much needed aid, however, our schools need consistent, recurring and predictable funding. We ask that the Legislature redirect the $203 million Fiscal Stabilization Fund and provide additional funding towards the goal of restoring the school aid that has been cut since 2008. We ask that this funding be reprogramed as traditional "operating aid" or "foundation aid" that would be built into the base of funding that districts can depend upon next year. Foundation Aid was designed to provide stable and predictable state funding for schools based on the cost of providing a sound basic education and adjusted for the extra costs of educating high needs students, regional cost difference and difference in local wealth.

Despite the fact that school aid is proposed to be added this year, there are still many, many districts that are looking at year to year CUTS in aid under the Governor's proposal. This is seemingly caused by a reconfiguration and $50 million decrease in funding under the High Tax Aid formula. At a minimum, districts should not lose these dollars year to year and this funding should be replaced.

Lastly, the Governor's plan to tie proposed school aid increases to agreements on teacher and principal evaluation systems going forward is problematic and would create an uncertainty that districts cannot afford. Since a school district will not be assured of any increase in aid unless an evaluation system is agreed to, school districts cannot count on any increase in aid for budget development purposes.

Tax Cap

The tax cap has and will continue to pose great challenges to school districts in meeting their obligations to educate every child. The average allowable tax cap was 2.6 percent in 2012-13 after adjustments. This cap does not even keep up with inflation which was 3.1 percent in the 2011 calendar year (the year that is used for the 2012-13 tax cap calculation). Maintaining the tax cap as it is will continue to force districts to eliminate programs

Living under a tax cap, most districts will be unable to turnaround the disinvestment in classroom services experienced over the last four years. Without significant additional aid, and a reasonable adjustment to the tax cap for costs beyond their control, many school districts will lack sufficient resources to fund current programs.

Finally, we are deeply troubled by the 60 percent supermajority requirement in terms of its disparate impact on low income and high minority school districts.

Pension

We are pleased that the Governor has recognized the need to address the recent, short-term increase in employer pension contributions.

NYSUT has long advocated for some type of pension smoothing to help offset the recent pension spike in employer costs. Legislation that would have provided school districts with a similar smoothing option has been pushed by NYSUT for several years.

Allowing school districts the option to address this temporary spike in costs through some type of leveling of pension payments will save education jobs, alleviate program cuts and increase investment in education across the state.

This said, any option that is enacted must also maintain the integrity of the state's retirement systems. The retirement security of both current and future public retirees must be protected. We have the strongest public pensions in the nation and we need to keep it that way.

COLA/Trend Factor for Special Education Schools and Human Service Agencies

Special Act Schools, 853 schools, 4410 programs and non-profit human service organizations have not received a COLA since 2008. The underfunding of these institutions is having a significant impact on their ability to provide the services that students and clients need and deserve. NYSUT asks that you provide a positive growth factor, which will allow these institutions the ability to more adequately serve the populations in need of their help.??

Special Act, 853 and 4410 schools provide for the specialized educational needs of students with severe learning, emotional, behavioral and physical disabilities. Non-profit human service providers are critical during these dire economic times as they assist our fellow New Yorkers with the use of food pantries, health clinics, homeless shelters, senior services, assist victims of domestic violence and offer our state's youth meaningful after-school programs.

In 2008, the state dramatically reduced the COLA for each of these institutions and, since then, has not provided them any COLA funding increase, which has forced them to absorb all inflationary cost increases. To continue to ask these institutions to forgo an increase is to ignore the difficult work, progress and critical assistance they provide.

Due to the state's failure to provide adequate funding, several BOCES pre-school special education programs are being forced to close. In Monroe and Nassau Counties, the BOCES will no longer be able to accept new enrollees beginning with the 2013-14 school year. The closure of these programs and others like it presents a significant educational and public health issue as well as future financial implications for school districts and the state. Early childhood education for all students, particularly for students with disabilities, is exceedingly important to a child's development and preparation for the K-12 system.

Please provide special education schools and human service organizations with a desperately needed COLA so the staff, students, programs and recipients of special services can receive the support they need.

Teacher Centers

The Executive Budget does not include any funding for Teacher Centers. Funding for these Centers has already been significantly reduced, down to just over $10 million annually. Now more than ever, investing in education and educational resources is essential not only to our economic recovery, but to continue increasing academic achievement. For years these centers have run one of the most successful public/private collaborations in education because they were designed to bring high quality resources to P-16 institutions while increasing student performance. Teacher Centers historically received $35 million in funding from the state and leveraged over $40 million worth of additional in-kind support from outside resources. Funding for Teacher Centers should be restored in the 2013-14 state budget.

Casino Revenues

While NYSUT does not have a position regarding the permissibility of casino gambling in New York State, we've followed this issue closely because the operation of casinos will likely have an impact on the revenue brought in by existing racinos whose revenue is currently dedicated to education. We were pleased to hear to the Executive proposes to provide 90 percent of new casino revenues to education. Additionally, this revenue would be provided on top of funding provided under the state aid cap. In other words, the funding will supplement and not supplant the funding that would otherwise go toward education.

Conclusion

NYSUT is eager to work in partnership with the Executive and the Legislature in order to secure the resources schools need for teachers to teach to high standards and students to learn to high standards.

Investments in education are critical to meeting the workforce demands of a global information and high tech economy and growing the state's economy. There is no better return for taxpayer dollars than maintaining our commitment to an excellent education for all school children.