Testimony of Andrew Pallotta, Executive Vice President, New York State United Teachers, to the Senate Finance Committee and Assembly Ways And Means Committee, Chairman DeFrancisco and Chairman Farrell, on the Education Budget for Elementary and Secondary Education

January 28, 2014

My name is Andy Pallotta, Executive Vice President of NYSUT (New York State United Teachers). NYSUT is a statewide union representing more than 600,000 members. Our members are pre-k to 12th grade teachers, school related professionals, higher education faculty, and other professionals in education and health care.

I'd like to thank the chairs of the Joint Fiscal Committees and the Chairs of the Assembly and Senate Education Committees for the opportunity to address you today regarding the Governor's proposed budget for elementary and secondary education.

SCHOOL AID

While we support several of the programmatic initiatives detailed in the Executive Budget, the proposed increase of $807 million for the 2014-15 school year, is wholly inadequate, and will result in substantial cuts to student programs and staff. Schools, educators and children across the state will need significantly higher funding than is provided in the Executive's proposal, especially with the school tax cap set at a mere 1.46 percent.

Prior years of state aid cuts, the enactment of the Gap Elimination Adjustment, freeze of the Foundation aid, coupled with the imposition of the tax cap, have all worked together to create a perfect storm of devastating conditions where school districts are unable to even maintain their existing educational programs, let alone bring back programs that were cut since the great recession.

Although state aid was increased by almost $1 billion last year, schools still lost more than 3,500 educator jobs. Over the course of the last five years, we have lost tens of thousands of educator positions in New York's schools, amounting to over 10 percent of the entire teaching workforce who would have been assisting our children in learning.

Under the Executive Budget, 69 percent of the state's 672 school districts would begin the 2014-15 school year with less state aid than in 2009-10. The Executive Budget increases school aid $807 million, however only $682 million is allocated to school aid, and only $603 million shows up on the school aid runs - only 2.9 percent.

While the proposal includes a $323 million restoration to the Gap Elimination Adjustment, it fails to increase Foundation funding - which is necessary to appropriately fund many high-need school districts, such as cities and certain rural schools.

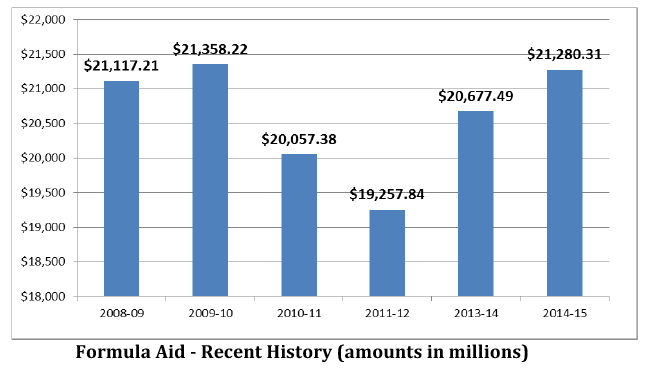

The proposed 2014-15 state aid to local school districts, $21.28 billion, is still below the 2009-10 level of $21.35 billion - five years prior.

Statewide, high-needs school district enrollment between the 2008-09 and 2013-14 school year increased by 3.1%. Yet these districts are seeing fewer funds.

Had New York State merely increased state aid by the rate of inflation over these five years, districts would have $2 billion more to support students and programs than they have today. Worse yet, under the court ruling in the Campaign for Fiscal Equity lawsuit, New York's school children should have over $5 billion more than they do under the Executive proposal.

State Comptroller Thomas DiNapoli identified 87 school districts in fiscal stress and noted, in his January 14 report, that "[t]he total amount of aid appropriated to schools in 2011-12 was $8 billion lower than what had been projected by the state in 2008-09." Further, the New York State Council of School Superintendents recently said that 40 districts report they would face fiscal insolvency within two years.

NYSUT and The Alliance for Quality Education (AQE) have advocated for a $1.9 billion increase in education funding this year, which would maintain existing school programs, and begin to fund critical services to children, like full-day pre-kindergarten and community schools.

The Educational Conference Board, in a report released in early January, estimated that a $1.5 billion school aid increase was necessary just to maintain current programs and services to students.

The $682 million increase in the Executive Budget falls far short of these figures, especially when the property tax cap for schools has been set at 1.46 for the upcoming year. Districts will

be unable to keep current student programs and services, and will be unable to restore those student programs that have already been lost.

New York's schools are still reeling from the multiple years of school aid cuts imposed upon them. These cuts have caused class-sizes to balloon, decimated course offerings and after- school programs, particularly music, art, and physical education, curtailed academic support for at risk children, eliminated counseling services, and rolled back early childhood programs including full-day kindergarten and pre-kindergarten.

We thank the more than 80 legislators, led by Members of Assembly Catherine Nolan, Chair of Education and Karim Camara, Chair of the Legislative Black, Puerto Rican, Hispanic & Asian Legislative Caucus who signed a letter backing our support for a $1.9 billion increase in the budget. To begin to repair the damage wrought by painful budget cuts, sufficient funding must be targeted towards New York's classrooms to help schools reverse years of classroom cuts and make the real investments that students and teachers need.

Further, we are appreciative of Senator Flanagan's call for a significant increase in funding for professional development for our educators.

Unless the Legislature acts to restore more money to our schools, this will be the fifth consecutive year that our schools will have to make devastating classroom cuts. These cuts impact ALL school districts - they are facing choices that will continue to erode educational programs across the state.

NEW INITIATIVES

FULL DAY PRE-K - $100 MILLION

The Executive Budget commits to invest $1.5 billion, cumulatively, over the next five years, beginning in school year 2014-15, to phase in full-day pre-K. For the 2014-15 school year, the Executive Budget includes $100 million in funding for this initiative, and would scale up to annual funding of $500 million in school year 2018-19.

We fully support investment in full-day universal pre-kindergarten.

Quality full-day pre-k opportunities lead to better outcomes in the academic and social development of children. Studies show that these programs increase graduation rates, reduce retention in grades, increase reading and math proficiency, and increase college participation and completion. The social and economic benefits are also striking. Quality pre-k experiences for children significantly reduce juvenile arrests, lower criminal activity, reduce teen pregnancies and result in healthier lifestyles.

Studies have shown that a student's participation in pre-k programs can significantly increase one's lifetime earnings potential. In short, the return on investment in pre-k is meaningful and has been estimated to be between $12-$14 in economic benefit for every dollar invested.

I had the honor of teaching in a high-needs elementary school and know, from personal experience, that one could readily determine which of my students had come from a high- quality pre-k program. These students were simply more school ready at a time when kindergarteners are already expected to have basic literacy skills such as knowing their letters

and numbers. It is far more cost effective and educationally sound to invest in school readiness at the front end rather than playing catch-up only after a student experiences failure and frustration.

This proposal builds on the phase-in of universal pre-k that was spearheaded by Assembly

Speaker Sheldon Silver and now serves over 100,000 four-year olds.

We also applaud New York City Mayor deBlasio for his tremendous efforts in advocating for universal pre-k for all city students.

AFTER-SCHOOL PROGRAMS

The Executive Budget appropriates $720 million over five years, beginning in school year 2015-

16, to support expansion of after-school programming. Approximately $160 million would be available in 2015-16, increasing to $200 million in the 2017-18 school year. This allocation would be funded from casino revenues.

We look forward to working with policy makers to ensure resources are targeted towards high- risk and high-need populations. After school programs must be educational in nature and staffed by educators to ensure students continue to receive sound instructional guidance in after school settings.

P-TECH EXPANSION - $5 MILLION

The Pathways in Technology and Early College High School program would be expanded with a

$5 million allocation in the Executive Budget. These programs target skills students would need for advanced STEM careers. Students entering this program receive both a high school diploma and an associate's degree, at no cost to the student or their family.

We support the continued expansion of early college high schools, and alternative ways for students to succeed academically.

TEACHER EXCELLENCE FUND - $20 MILLION

The Executive Budget would establish a $20 million teacher excellence fund for those teachers determined to be "highly effective." Annual supplements, up to $20,000, could be awarded to those teachers rating "highly effective" on their Annual Professional Performance Review final composite score.

I am deeply concerned over any proposal to impose "merit pay" on schools, where teachers would be pitted against one another in a high-stakes monetary game. Tying pay to a rating system that was undermined by the terribly flawed roll out of Common Core is problematic, especially when student growth data on new Common Core assessments is being used in the evaluation process.

Educational researchers have found a number of significant weaknesses in merit pay programs, and despite the hundreds of research studies that relate to merit pay, no study has shown with any degree of conclusiveness that merit pay improves the overall quality of instruction. It has also never been shown that students benefit from merit pay.

Research has shown that merit pay promotes competition among teachers and destroys cooperative efforts to reach common educational goals. Any system that creates a competitive, rather than collaborative, school climate raises real concerns.

Career ladders, however, would be an appropriate use of these funds. Extra pay for other assignments, such as mentoring new educators or working on advanced degrees and professional development should be negotiated with teachers through local collective bargaining.

We urge you to reject any "merit pay" proposal in favor of a career ladder approach torewarding excellence in teaching.

SPECIAL EDUCATION SCHOOLS AND PROGRAMS

The Executive Budget makes reforms to the reimbursement and rate-making process for preschool special education programs (4410 programs). Changes to the 4410 programs include, establishing regional rates for payment to program providers; authorizing New York City to establish its own rates and negotiate directly with potential providers; and limiting the reimbursement to services delivered. These modifications are estimated to save the state $71 million over the next five years.

Further, preschool special education providers have not received a cost of living adjustment (COLA) on their reimbursement rates in over six years. As New York State looks to expand and make an investment in universal pre-k, equal attention should be paid to the crucial role of 4410 programs, which provide services for children with special needs.

NYSUT has requested changes to provide for equitable funding for special education providers. Unfortunately, the reforms in the Executive Budget fall short of what these programs need - a positive growth factor. The changes proposed in this budget do nothing to keep these programs from relying on bank loans in the form of Revenue Anticipation Notes (RANs). 4410 programs deserve educational funding parity between students with disabilities at special education schools and students from public school districts.

Unfortunately, needs of as 853 schools and Special Act schools have not been addressed. 853 and Special Act schools have suffered from the same insufficient funding and a complicated and inflexible rate making process. There was a 3 percent increase provided to 853 and Special Act schools in 2013 and still, these programs, the educators and their students are in dire need of consistency and parity with their public school counterparts. 853 and Special Act schools are critical to the K-12 system and deserve the same investment as traditional public schools.

Students and parents rely on these schools and services. Please provide special education schools and programs with a COLA and an equitable funding stream so that the staff, students, programs and recipients of these services can receive the support they need.

TEACHER CENTERS

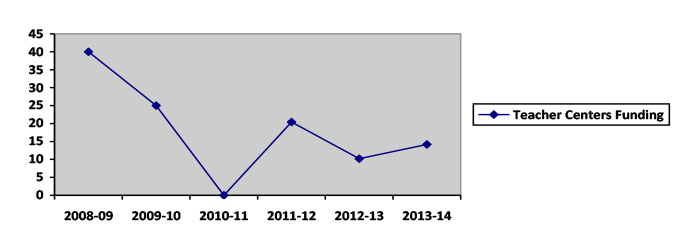

Teacher Centers were established by the state Legislature in 1984 to provide comprehensive, ongoing professional development and support services to our teachers. They are the only state-funded vehicle guaranteed to support teacher professional development in all school districts, including 205 high-need schools/districts, BOCES, non-public and charter schools.

The Executive Budget fails to fund these critical centers for educators. The 2013-14 school year funding level for Teacher Centers (14.26 million) is less than it was in 1996-97 (15 million). Funding should be restored to at least its 2008-09 levels of $40 million.

Teacher Centers support programs that ensure educators are exposed to emerging techniques, practices and technologies to be increasingly effective in the classroom and help close the achievement gap. They also offer courses and programs that enable new teachers to satisfy certain professional requirements.

Many centers are using a highly effective coaching model to aid teachers in understanding the Common Core standards and how they intersect with the NYS Learning standards, including alignment with the State-issued curriculum modules.

Teacher Centers upstate are supporting educators implementing the common core with strategies to differentiate their instruction and adapt to the poverty that many of their students experience. On Long Island centers are providing professional learning that addresses a specific area of need identified, such as Algebra. Other centers throughout the state are conducting regional forums that promote family engagement with the Common Core and its requirements while other centers have begun working with local higher education institutions to better prepare teacher candidates for the Common Core.

Teacher Centers are also economic engines for the state. These centers have run the most successful public/private collaborations in education because they bring high-quality resources to Pre-k-16 institutions. They maximize resources and leverage existing purchasing agreements to provide significant savings to property taxpayers. These centers work with many colleges, universities, museums, youth bureaus, early childhood agencies and workforce investment boards. They also collaborate and partner with corporations like Microsoft, Apple, Adobe, Verizon, Google, and Dell. They have brought in over $36 million in additional private contributions through grants, business and industry collaborations.

At a time when we are asking educators to comply with higher learning standards to ensure all students are on track for college and career readiness, we must first provide educators with the resources and tools they need to meet this demand.

We applaud Senator Flanagan for advocating for a significant investment in professional development, to counterbalance the inappropriate phase-in of the Common Core State Standards.

MORATORIUM ON THE USE OF STATE ASSESSMENTS

There is widespread concern with the State Education Department's implementation of the new Common Core standards among students, parents, educators, advocates and legislators. New York's students and educators need more time and resources to adapt to tremendous changes in testing and curriculum, and evaluation.

I am extremely concerned about the developmental appropriateness of many of the new Common Core Modules developed by the State Education Department, and tremendously concerned over increased testing and testing solely for teacher and principal accountability purposes.

We must give students and educators time to adapt to new demands for higher 21st century learning and ensure the proper sequencing of curriculum for student learning: from curriculum development, educator understanding, student learning, and limited necessary testing.

That is why NYSUT is calling for a three-year moratorium on high-stakes consequences for students and teachers. We cannot hold students and educators accountable for material they have not yet learned or been taught and cannot penalize children and teachers for the poor implementation of the Common Core.

BAN ON STANDARDIZED TESTING FOR OUR YOUNGEST STUDENTS

The legislature and governor have indicated support of a ban on the use of standardized testing for students in pre-kindergarten through second grade. We fully support these efforts and look forward to working with policy makers to quickly enact legislation that protects our youngest students from developmentally inappropriate testing.

More and more, our youngest students are being forced to take commercially developed standardized tests that are not being used for diagnostic purposes or to identify their academic needs.

There is uniform agreement among parents, educators, and policy makers that standardized tests for our youngest students are inappropriate. Parents are reporting that their children are suffering from anxiety, stress, and have become less engaged in the learning process.

NYSUT fully supports banning the use of standardized testing for students in Pre-K through grade two. We must foster the love of learning in early ages; not begin their educational path with over testing and bubble tests.

SPECIAL EDUCATION MANDATE RELIEF

The Executive Budget would allow districts, BOCES and approved special education providers the ability to petition the State Education Department for flexibility in complying with certain special education requirements.

We oppose this proposal, as it would allow the erosion of needed protections for our most vulnerable students.

The Legislature has already made strides in providing mandate relief for students with special needs. Not that long ago, the Legislature authorized school districts the option for a teacher to have access to a student's individual education program (IEP) electronically and further, in NYC, by automatically eliminating a parent member on the Committee on Special Education (CSE).

The enactment of a waiver to current statutory and regulatory special education mandates could erode the quality of education to these students and diminish the protection these necessary mandates provide.

SMART SCHOOLS BOND ACT OF 2014

The Executive Budget proposal seeks voter approval in November 2014 for a thirty year, $2 billion bond act aimed at increasing educational technology and building or expanding Pre-K facilities.

If approved, the funding would be spent on educational technology and other initiatives, including:

- high-speed and wireless internet connections in schools or within their community;

- learning technology such as whiteboards, servers, desktops, laptops and tablets; and

- construction of new or improved pre-kindergarten classroom space.

We could not agree more that our students deserve the most up-to-date technology; our students deserve the best.

Schools need continued and increased funding for technology, as we move towards a 21st century learning environment. We are concerned, however, that approval by a review board weakens local control in the decisions for use of desperately needed funds to best benefit students.

TAX CAP

The tax cap is unconstitutional; its impact continues to pose great impediments to school districts in meeting their obligations to successfully educate every child. This year's allowable tax cap for schools is 1.46 percent (local governments have a 1.66 percent tax cap). This is nowhere near the 3.7 percent forecast of cost increases for current programs estimated by the Educational Conference Board in their January report. This devastatingly low percentage will have serious negative effects on our students and their schools.

Living under a tax cap, most districts will be unable to turnaround the disinvestment in classroom services experienced over the last five years. Without significant additional aid, and a reasonable adjustment to the tax cap for costs beyond their control, many school districts will lack sufficient resources to fund current programs.

Further, we are deeply troubled by the undemocratic 60 percent supermajority requirement in terms of its disparate impact on low-income and high-minority school districts.

TAX RELIEF PROPOSALS

NYSUT believes that the over $2 billion dollars this plan will cost the state would be better spent filling the gaps left in education and in other public services caused by state budget cuts over the last several years.

New York State has lived through five consecutive years of austerity budgets under which our students have had to sacrifice. Now, the Executive Budget proposes to use the savings from those "bad times" budgets to provide tax breaks that are aimed, for the most part, at banks, corporations and wealthy New Yorkers.

A plan that provides increased tax cuts to corporations and a select number of wealthy estate inheritors do nothing to restore drastic cuts to the programs and services our members provide. Such tax breaks come at a time when the needs are high and local reserves have been substantially depleted.

TWO YEAR PROPERTY TAX "FREEZE"

The proposed two-year property tax "freeze" is a regressive tax expenditure that would disproportionately favor high-income New Yorkers, cause disinvestment in schools, and exacerbate inequality of educational opportunities for children in New York State.

The property tax "freeze" would provide a credit to a homeowner equivalent to the difference between the freeze and the levy increase, provided the levy increase is below the 1.46 tax cap. The income eligibility would be up to an extremely generous $500,000 adjusted gross income, which would provide the largest benefits to high income individuals while simultaneously starving schools of revenue needed to fund adequate services.

In the second year of the tax "freeze", the school district and/or local government must also develop a plan for sharing or consolidating services, eliminating duplication of government services or consolidation or dissolution of governments or school districts.

Each plan submitted in year two of the tax freeze must achieve aggregate savings of at least one percent of the participating entities' tax levy in year three. The plan must also achieve aggregate savings of at least two percent and three percent in years four and five.

This is a perverse incentive to disinvest in schools, since the "freeze" would require school districts to stay under the property tax cap - now set at 1.46 percent. Forcing districts to stay under the cap in order for a homeowner to receive a break on their taxes is harmful and will pit homeowners against the very schools that serve their families.

To mandate schools reduce their spending while underfunding them at the same time is inexcusable and will continue to force districts to cut programs and services to students.

PROPERTY TAX "CIRCUIT BREAKER"

The Executive Budget proposal seeks to establish a residential real property personal income tax credit, or "circuit breaker." The credit would be a refundable tax credit against the state personal income tax for incomes up to $200,000.

The credit would be available statewide, but in areas outside of New York City, only residents of school districts and local governments that adhere to the property tax cap would qualify for the credit. Therefore, for a homeowner to receive the $500 tax credit in 2014 and subsequent years, the school district must stay within the tax cap levy limit, set at 1.46 percent for school year 2014-15.

While NYSUT has long supported the concept of a tax circuit breaker, tying a circuit breaker to the constitutionally questionable tax cap will only create an even larger incentive to cut important classroom programs and services without regard to the education and local service needs of a community.

Forcing districts to stay under an undemocratic tax cap, while schools across the state are underfunded, will have devastating impacts on student programming and services.

CLOSE TO HOME INITIATIVE

The Executive Budget authorizes the Office of Children and Family Services (OCFS) facilities to contract with BOCES to provide any and all educational services at OCFS facilities that BOCES provides to school districts. Additional BOCES services may include subjects such as foreign language, music, art, career/technical skills and others.

Making provisions for students requiring special education services to obtain those state services has been a priority for providers. Allowing students to remain in state will increase funding for these programs.

CONCLUSION

NYSUT looks forward to partnering with the Executive and Legislature to ensure our students receive the necessary resources and programs for a 21st century high-quality education, in order to prepare them for college and career readiness.

There is nothing more important than investments in our students and their future, and no better return on this investment than to provide the best possible education for all school children to enable them to succeed.