Testimony of Andrew Pallotta, Executive Vice President, New York State United Teachers, to the Senate Finance Committee, Catharine Young, Chair, and Assembly Ways and Means Committee, Herman D. Farrell, Jr., Chair, on the Proposed 2017-18 Executive Budget for Elementary and Secondary Education

February 14, 2017

Senator Young, Assemblyman Farrell, honorable members of the Legislature and distinguished staff, I am Andrew Pallotta, Executive Vice President of New York State United Teachers (NYSUT). NYSUT represents more than 600,000 teachers, school-related professionals, academic and professional faculty in higher education, professionals in education, in health care and retirees statewide.

Thank you for the opportunity to testify today on the proposed 2017-18 Executive Budget for Elementary and Secondary Education. I am joined by Michael Mulgrew, President of the United Federation of Teachers.

The state of public education in New York is improving, however, we have much more to do.

We must continue to work together to ensure each and every student receives a high quality education that prepares them for college and career.

We must continue to work towards reducing unnecessary testing in our schools.

We must restore the joy of learning and teaching in our classrooms.

Before commenting on the Executive Budget proposal, I want to thank the Legislature for working with the Governor to fully eliminate the Gap Elimination Adjustment in the 2016 State Budget. This remnant from the dark fiscal days of 2010 significantly reduced funding to our schools, and now that it is gone we can turn our attention to a discussion about how we should properly fund our public schools.

The 2017-18 Executive Budget provides a year-to-year increase of $1 billion, or four percent in overall support for K-12 education, of which $768 million is traditional formula school aid. While this formula aid increase is one of the largest school aid starting points we have seen in recent years, significantly more funding is needed to maintain current levels of academic services and programs and to provide many needed enhancements in school districts across New York State.

This year in particular, state support for schools is critical. The tax cap is extremely low; set at a mere 1.26 percent – NOT two percent. This low tax cap will greatly impede local school districts’ ability to raise revenue. Under this year’s tax cap, only $200 million can be generated by school districts state-wide. This places an even greater importance on school aid for 2017-18, as it will be the sole source of additional revenue for many school districts.

Foundation Aid

While the 2017-18 Executive Budget proposal includes a number of progressive changes to the Foundation Aid increase of $428 million dollars, we strongly urge you to reject the proposal to eliminate the Foundation Aid formula.

As you are aware, the Foundation Aid formula was enacted in 2007, following the resolution of the Campaign for Fiscal Equity (CFE) lawsuit. The formula represented a significant policy success and an important reform of the state’s education funding system. Foundation Aid incorporates the cost of educating a student, the needs of students within each district, variations in regional costs and the district’s local ability to support the cost of educating its students. The formula also serves as a way for districts to understand and plan for the level of state support that they should expect to receive in a given year. This level of funding is rooted in the ability of districts to provide their students with a sound basic education, as guaranteed by the State Constitution. It is for these reasons, we must keep the Foundation Aid formula in place. We are open to changes to improve the formula, such as incorporating progressive measures, however, we firmly believe we must keep the Foundation Aid formula.

NYSUT supports a real commitment to fully-fund the Foundation Aid formula within three years, with the progressive changes proposed in the Executive Budget. Repealing the Foundation Aid formula would leave schools without any plan for additional financial support beyond 2017-18. This would return the state to an unpredictable and undependable school funding system, subject to unnecessary annual manipulation. The concept of Foundation Aid provides school districts and their communities with a level of transparency that fosters productive discussions about achieving school success. This enhances participation in the educational process and leads to higher levels of accountability.

New York public school students are still owed $4.3 billion in Foundation Aid funding. These funds are "owed" because State law currently calculates the total amount of Foundation Aid due to each school district. While the state has never come close to fully funding Foundation Aid, this was the promise of the much heralded reforms in school aid that were enacted ten years ago. Again, we call on the state to fully phase-in the foundation aid formula, with positive, progressive changes, within three years, to ensure that children are not denied the opportunity to a sound basic education that our State Constitution requires.

School Aid

The 2017-18 Executive Budget proposal allocates $25.6 billion in funding for education, an increase of $1 billion. This year’s Executive Budget proposal includes a $428 million increase in Foundation Aid, $50 million of which is set aside to transform additional high-needs schools into community schools with wrap-around social services.

The $1 billion is allocated for 2017-18 as follows:

- $428 million in Foundation Aid, or a 2.6 percent increase, which includes $50 million for the creation of community schools;

- $333 million in expense based aid, which includes BOCES;

- $150 million in unallocated school aid; and

- $89 million in other programs (e.g., after-school programs, expansion of pre-kindergarten).

Of the community schools’ money, $50 million is new money, while $100 million is continued from 2016-17 for a total of a $150 million.

The four percent increase is the highest proposed starting point put forth in recent years, however, more school aid is needed in the Enacted Budget, especially with a tax cap of 1.26 percent. The Regents and the Educational Conference Board estimate that school districts require a total increase of $1.7 billion to maintain existing services. Remember, due to the tax cap, only $200 million of that total can be raised by districts state-wide, placing greater importance and pressure on state support of our schools to maintain current services and programs for students. State aid, on average, only makes up 35 percent of school district revenues. Every school district in our state needs a minimum increase in aid to ensure they can cover the ongoing costs of existing programs.

The Board of Regents has called for at least a $2.1 billion increase in school aid. NYSUT echoes the call for an increase of $2.1 billion in general purpose school aid and urges the Legislature to provide this level of funding in the Enacted Budget. Specifically, we call for a total increase in Foundation Aid and fully funding expense based aids in the amount of $1.5 billion and targeted funding of $600 million that would be used to:

- Provide continued support for struggling schools;

- Increase funding for ELLs;

- Expand pre-kindergarten;

- Invest in high-quality professional development;

- Expand access and support for college and career pathways; and

- Assist districts with growing enrollment.

While school districts have made some progress in restoring various programs in recent years, unfortunately, New York’s public schools are still reeling from recessionary cuts. These cuts have decimated course offerings, causing class sizes to balloon. They have taken a serious toll on music, art, physical education and after-school programs. These cuts have also curtailed academic support for at-risk children and eliminated counseling services.

Another important issue for NYSUT is the growing number of school districts that have been or will be affected by power plant closures. We urge the Legislature to provide funding in this year’s budget to ensure school districts are fully reimbursed by the state when districts are affected by the closure of power plants, like Indian Point, or where the full valuation of a tax base has been reduced, such as in North Rockland. The Legislature has appropriated funds for school districts already facing these issues, such as KenTon in Western New York, and we ask for your continued commitment to affected districts.

There is another area of major concern for us contained within the Executive Budget proposal.

Very worrisome, is the attempted legalization of the impoundment of funds, including school aid, should revenue, either federal or state funds, fall below projections in the state’s financial plan. This action could be taken by the Director of the Division of the Budget, without consultation or approval of the Legislature, at any time. Currently, the Legislature must vote on any changes to appropriations that are enacted for localities. NYSUT believes this should continue. There should be meaningful consultation and input between the Legislature, education stakeholders, the health care field and local governments to ensure critical programs and services are not negatively impacted.

State Revenue

The Executive Budget extends the “Millionaires’ Tax,” which raises over $4 billion annually and is set to expire at the end of the 2017.

The Fiscal Policy Institute found that “New York households with incomes under $100,000 pay higher effective state and local tax rates, ranging from 10.4% to 12%, than the richest 1% of households, who pay 8.1%.”

NYSUT urges the Legislature to pass the Assembly’s progressive tax plan for the state’s highest earners which would raise $5.6 billion in new revenue annually to support public education, health care and infrastructure improvements. This tax plan, both fiscally and socially responsible, would keep the current tax rate on New Yorkers earning between $1 million and $5 million at 8.82 percent, and create three new tax rates: 9.32 percent tax rate on people earning between $5 million and $10 million; 9.82 percent tax rate on individuals earning between $10 million and $100 million; and a 10.32 percent tax rate on wealthy New Yorkers earning more than $100 million.

This common sense proposal needs to be enacted to ensure that our schools, colleges, and healthcare institutions have the resources they need to properly educate these students and treat those seeking care.

Additionally, NYSUT fully supports closing the “carried interest” loophole, which allows partners at private equity firms and hedge funds pay a greatly reduced federal tax rate on much of their income, by declaring it to be capital gains. By raising state income taxes on private equity and hedge-fund partners who live in New York, making it equal to the tax savings they receive from using the loophole at the federal level, it is estimated that New York State would receive over $3 billion. We urge you to enact these proposals.

Community Schools & Receivership

NYSUT thanks the governor and the Legislature for their leadership and commitment to Community Schools which provide wraparound services for our neediest students. Community schools have been successful in: closing the achievement gap; reducing chronic absenteeism especially due to inadequate health care; reducing grade retention; reducing dropout rates; increasing graduation rates; and increasing student participation in afterschool and summer programs.

The Executive Budget contains a provision that would require school districts to set aside $150 million from Foundation Aid for community school conversion, an increase of $50 million over 2016-17, for districts with struggling schools or with significant ELL populations. These funds continue to be allocated via a formula to all eligible school districts. The proposal also eliminates $75 million that was included in the 2015-16 Enacted Budget to convert struggling schools into community schools over a two year period. NYSUT strongly opposes the discontinuation of this funding.

Our schools should not only provide education and instruction but also address the social and emotional needs of our students. Social and emotional development and learning plays an important role in making schools safe, maintaining a caring school climate and enhancing student motivation. We need to ensure that trained professionals such as certified school psychologists, school social workers and school counselors are available in our schools to support students and provide appropriate clinical services when necessary.

NYSUT urges the Legislature to maintain $255 million in existing community school funding, which includes the restoration of $75 million for continued struggling schools conversions and add $100 million in new capital to adequately fund and sustain community schools statewide, through a Community School Categorical Aid. Funding for community schools is critically important and should supplement, not supplant, Foundation Aid.

The Executive Budget does not amend the 2015 Receivership Law. With respect to the issue of receivership, the law attempts to centralize power, privatize public education and strip away local control from parents and their local, democratically elected school boards. NYSUT strongly opposes the Receivership Law as it mislabels schools, students and educators based on the failed implementation of the Common Core and flawed state standardized test scores, without taking into account the progress made in existing local turnaround programs. This law blames educators, rather than addressing the real fundamental problems that are symptomatic of these schools – chronic underfunding and high concentrations of students living in poverty.

There is no evidence or rational argument to suggest that firing educators has anything to do with raising student achievement. This harmful provision in the law strongly discourages educators from working in struggling schools, as these schools serve large high-needs populations. We should support our teachers in these schools, not penalize them.

NYSUT calls for a repeal of the receivership law and urges the state to support policies that have been proven to increase student achievement by allowing struggling schools to use realistic, research-based tools, time frames and solutions to properly turn around these schools. We call on the Legislature to enact legislation this year to require any school on the receivership list to automatically become a community school. While persistently struggling schools were promised approximately $70 million (of $75 million) in grant funding that was allocated in the 2015-16 Enacted Budget to support their school turnaround efforts, to date, none of these schools have received any of these funds. Struggling schools were not provided any additional assistance to implement their plans when receivership was imposed.

In the 2016-17 Enacted Budget, $75 million in grant funding was earmarked to help both persistently struggling and struggling schools invest in programs modeled on Community Schools. To date, none of this funding has been disbursed.

Due to years of inadequate funding, school districts with struggling schools have been forced to make difficult financial decisions regarding staffing, programs and services. These decisions have impacted both the school and students' academic performance. These schools have common characteristics: underfunding by the state and chronic poverty.

We urge the Legislature to make sure these schools receive the $150 million that was allocated to them over the last two years.

Teacher Centers and Other Professional Programs

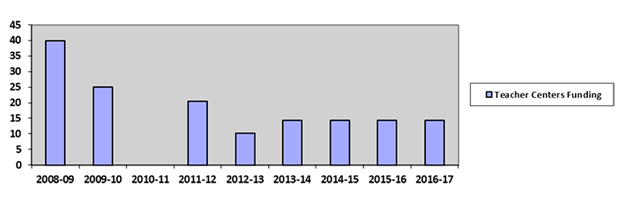

I would now like to turn your attention to professional development and professional programs for educators. The Executive Budget eliminates $14.26 million in funding for Teacher Centers. Teacher Centers are the only state funded vehicle guaranteed to provide comprehensive, ongoing professional development and support services to educators and school-related professionals in all school districts, including more than 200 high-needs districts, BOCES, non-public and charter schools. We ask that funding be restored to at least its 2008-09 level of $40 million.

These centers assist educators by offering strategies to differentiate their instruction, adapting it to the poverty-stricken environments where many of their students reside. The statewide teacher center network has already developed, and is offering, professional learning sessions for educators who work with English Language Learners (ELLs). Teacher Centers provide customized professional learning sessions to meet the unique needs of ELLs. The centers have developed, and are currently sharing, “ELL anchor lessons” targeting ELA, Math, Science, and Social Studies for pre-K – 12 educators and school related professionals.

Additionally, Teacher Centers have created professional development sessions that may be accessed in-person or online so educators from across the state can easily benefit from their services. This is especially beneficial for rural districts in need of high-quality professional development.

The Executive Budget funds the Mentor Teacher/Intern Program (MTIP) at $2 million. MTIP provides support for new educators by easing the transition from teacher preparation to practice, ultimately increasing the skills of new educators. This program reflects best practices in mentoring, improves teacher quality and helps bolster the educational performance of students instructed by new teachers. We respectfully request that funding for this program be increased to its 2008-09 level of $10 million to provide more opportunities and support services for new educators.

The Executive Budget funds National Board Certification, the highest credential in the teaching profession, at $368,000. The impact of National Board Certification on student learning, school climate and teacher effectiveness continues to be confirmed by numerous research studies and leading measures of teaching effectiveness. National Board Certification is a highly respected, professional, voluntary credential that provides numerous benefits to teachers, students and schools. It was designed to develop, retain and recognize accomplished teachers and to generate ongoing improvement in schools by enhancing teacher effectiveness and supporting improvements in teaching and learning. We ask that funding be increased to $1 million to develop, retain and recognize accomplished educators and to facilitate ongoing progress in schools by enhancing teacher effectiveness and supporting improvements in teaching and learning.

Tax Cap

As I have already mentioned, the 1.26 percent tax levy limit for 2017-18 will have serious negative effects on our students and their schools. Eliminating or amending the tax cap continues to be a priority for NYSUT.

Living under a tax cap has hindered most districts’ ability to restore recessionary cuts to classroom services. Without significant additional aid, and a reasonable adjustment to the tax cap for costs beyond their control, many school districts will lack sufficient resources to fund current programs. The tax cap hurts our poorest districts the most, placing severe limits on their ability to raise funds.

Short of a full repeal, NYSUT urges the Legislature to enact the following changes to the current tax cap:

- Change the allowable tax levy limit to two percent or CPI, whichever is greater;

- Eliminate the supermajority requirement;

- Eliminate the possibility of negative levy limits; and

- Allow for exemptions to include items such as increased enrollment, spending on school security measures, BOCES capital expenses and including PILOTs (payments in lieu of taxes) in tax base growth factor determinations.

Charter Schools

I would now like to turn to the issue of charter schools. In the absence of much needed transparency and accountability measure for charter schools, NYSUT opposes proposed increases in tuition payments, rental aid and any other costs associated with charter school management operators.

NYSUT analyzed the unfreezing of basic tuition formula payments and 2016-17 charter school enrollment levels provided by NYSED and have concluded that 156 school districts would incur additional costs, at a minimum, of $120 million in the aggregate. This cost is likely to be much larger, however, because it does not include charter school enrollment growth due to expansions or new school openings. If enacted, this could lead to an enormous unfunded mandate on public school districts since funding is paid from public school budgets. In addition, it could exacerbate funding issues in areas where there is already an oversaturation of charter schools.

The Executive Budget provides an increase of approximately $6 million in Charter School Transitional Aid, increasing this funding to $39 million. Under current law, if total enrollment attending charter schools in a school district exceeds 2 percent or if total spending on charter school tuition exceeds 2 percent, then the district qualifies for this aid. The proposal amends this provision of the law and raises the bar for school districts to receive these funds to 5 percent of enrollment or 5 percent of total spending for this new Transitional Aid. This additional funding is still paid by the school district and then reimbursed by the state on a one-year lag.

Moreover, the property tax cap law treats public schools and charter schools differently. Unlike public schools, charter school budgets can increase without any public approval. The property tax cap law holds charter schools harmless but requires public school districts to provide increased funding if the charter school enrollment increases. NYSUT believes it is unfair to taxpayers to enact legislation that does not provide transparency to the public regarding charter management operators who support these schools.

In New York City, the calculation of rental aid for charter management is increased to 30 percent, up from 20 percent. The Executive Budget also removes the regional restriction on the number of charter schools permitted in NYC. The proposal would also require a charter’s entire planned grade configuration – elementary, middle or high school, to be located within a single building, including grade levels not yet in operation at the time of offering. Additionally, the proposal would also require charter payments to include lease payments, maintenance, capital improvement and any other costs associated with the rental expenses of such facility.

NYSUT calls for the enactment of critical reforms to make charter management operators more transparent and accountable to the public. These reforms should: establish the ability to audit monies being sent to education management organizations and other outside charter entities; require charter regulators and their management companies to agree to publicly provide any and all financial records related to their schools; ensure charter schools enroll and appropriately educate English Language Learners, students with disabilities, students living in poverty and students in temporary housing; ensure students are treated fairly; provide more transparency and accountability in the use of state funds; and restrict charters to hold the same percentage of reserves as public schools.

Again, without the enactment of legislation to ensure this much needed transparency and accountability, the state should not be providing any more state resources to charter schools.

Pre-Kindergarten Expansion for three-year old children

In the area of pre-K education, the Executive Budget proposes an increase of $5 million in funding for three- and four-year olds and also standardizes several pre-K funding streams and consolidates them into one program to ease the administrative burden on school districts and pre-K providers state-wide.

We wholly support continued investment in full-day universal pre-kindergarten and support full investment for full-day kindergarten for every child.

As a former classroom teacher in a high-needs elementary school, I know, from personal experience that one can readily determine which students come from a high-quality pre-K program. Quality full-day pre-K opportunities lead to better outcomes in the academic and social development of children. Studies show that these programs increase graduation rates, reduce retention in grades, increase reading and math proficiency and increase college participation and completion. The social and economic benefits are also striking. Quality pre-K experiences for children significantly reduce juvenile arrests, lower criminal activity, reduce teen pregnancies and result in healthier lifestyles.

It is far more cost-effective and educationally sound to invest in school readiness at the front end rather than playing catch-up on the back end, after a student experiences hardships and frustration.

Career and Technical Education and Early Career High School Expansion

Another important issue for NYSUT is Career and Technical Education (CTE). In 2015, the New York State Board of Regents approved multiple pathways to high school graduation and made changes to diploma requirements. This pathway provides work-based learning opportunities and allows students to take approved, rigorous examinations which tests their knowledge of technical skills to fulfill part of the Regents examination graduation requirement. The New York State Board of Regents has emphasized that funding support is essential for building multiple pathways to high school graduation for students.

NYSUT urges you to include the provisions contained within A.2363 (Nolan)/S.3919 (Ritchie) in this year’s Enacted Budget. This legislation provides resources to support and expand access to CTE programs in BOCES, component districts and the Big 5 School Districts.

Additionally, the current aid formula for BOCES CTE programs has not increased since 1990. The state only provides aid for the first $30,000 of a BOCES instructor’s salary. The state should update the BOCES aid formula by increasing the aidable salary to the state average salary.

Similarly, Special Services Aid provides state support for CTE programs in the Big 5 School Districts. This funding formula pre-dates the Foundation Aid formula and should be updated to use the Foundation Aid per-student formula to calculate the aidable amount per student.

Additionally, Special Services Aid is currently limited to grades 10-12 in the Big 5 School Districts – 9th grade should be included to align these types of programs with the Regents’ adoption for multiple pathways to graduation.

Both of these funding gaps reduce state support for CTE programs and shift the costs of these vital programs to local school districts. New York should invest sufficient funding in order to respond to the economy’s increasing demand for diverse and technically prepared workers.

4201, 4410, 853 And Special Act Schools

NYSUT continues to strongly support the missions of 4201, 4410, 853 and Special Act schools. We call on the state to work towards achieving educational funding parity with our school districts, specifically, we urge the Legislature to provide regular, predictable increases in their tuition rates. While the increased funding of the last several years for 4201 schools is maintained in the Executive Budget, more funding should be provided to these special schools to ensure students receive the services they need and they have the appropriate staffing levels to provide those services.

Specialized schools have no taxing authority, nor do they receive typical school aid increases that benefit public school districts and their students. Students attending these schools have specialized educational needs that cannot be served in another setting. We urge the Legislature to ensure that they receive adequate support so they may better plan and prepare for the future without the worry of financial insolvency. As you move into budget negotiations, we urge you to provide all these schools with a funding percentage increase on par with that of our traditional public schools.

NYSUT supports the establishment of a system that would guarantee annual increases in state support tied to the personal income growth index used to calculate the allowable growth of school aid. For 2017-18 this would result in a 3.9% increase.

We also strongly support the provision contained within the Executive Budget that provides $6.2 million for increased salaries for staff in 4201, 4410, Special Act and 853 schools, who are covered by the increased minimum wage enacted in 2016, and $225 million to cover similar cost increases for health care workers.

After-School Programs

NYSUT strongly supports the 2017-18 Executive Budget proposal to add $35 million to create 22,000 new after-school slots in sixteen high-needs districts. After-school programs provide a fantastic opportunity to enrich and improve a child’s academic, social and emotional well-being.

Special Education Management Flexibility

NYSUT opposes the Executive Budget proposal that would allow school districts, BOCES, approved special education providers and private schools the ability to petition the State Education Department for flexibility in complying with certain special education requirements. This proposal would erode the quality of education for these students and diminish the protections these critical resources provide in educating our students with disabilities. Accordingly, we urge you to reject this language.

Buy American

Finally, NYSUT fully supports the expansion of the existing "Buy American" program, which currently covers only steel, iron and other construction materials on large scale building projects.

Broadening this program to all state contracts, including SUNY and CUNY facilities projects, make sense.

New York State spends billions of dollars annually to purchase goods and services for government projects and agency activities and we should be supporting American manufactures which have a greater chance of being produced using union labor.

Conclusion

In conclusion, there is nothing more important than investments in our students and their futures, and NYSUT looks forward to partnering with the Legislature to ensure our students receive the necessary resources and programs for a high-quality 21st century education that prepares them for college and career.

Again, thank you for the opportunity to testify before you today. I will now turn it over to Michael Mulgrew, President of the United Federation of Teachers.

JP/JL/ACB/CB 2/13/17

43494