Testimony of Andrew Pallotta, Executive Vice President, New York State United Teachers, to the Senate Finance Committee and Assembly Ways and Means Committee, Chairman DeFrancisco and Chairman Farrell, on the Education Budget for Elementary and Secondary Education. February 3, 2015.

My name is Andy Pallotta, Executive Vice President of New York State United Teachers. NYSUT is a statewide union representing more than 600,000 members. Our members are pre-k to 12th grade teachers, school related professionals, higher education faculty, and other professionals in education and health care.

I'd like to thank the chairs of the Joint Fiscal Committees and the Chairs of the Assembly and Senate Education Committees for the opportunity to address you today regarding the Governor's proposed budget for elementary and secondary education.

Governor Cuomo's budget is an assault on public education; our students, parents, local school boards, educators, and the teaching profession. These proposals constitute the worst attack on educators and public schools in the state's modern history.

The Governor is holding each and every school district and child hostage; by not offering any school aid formulas, no school aid runs, and dictating that no school will receive any increase in constitutionally protected and court ordered school aid, unless his draconian and anti-public school reforms are passed.

Further, the alleged year-to-year increase in school aid of $1 billion is nowhere near the $2 billion request made by the New York State Board of Regents, as a minimum necessary to support public schools.

The Governor's harmful "reforms" include:

- more emphasis and pressure on students taking standardized tests, contributing to the over-testing of our children;

- the power to fire all educators and employees within a school district;

- eliminating local control for districts, superintendents and public elected school boards;

- eliminating due process for educators, seniority, and collective bargaining agreements and rights;

- making tenure near impossible to attain for new teachers;

- siphoning of hundreds of millions of public dollars away from schools, human service programs, and health services, via a back-door voucher scheme and tax giveaway to the wealthy;

- increasing the number, and funding for, corporately-run charter schools;

- intention to make the tax cap permanent - locking in inequality in school funding, eroding local control and further damaging our highest need schools; and

- eroding special education requirements, raising serious concerns about lessening of services for students with disabilities.

School Aid

The 2015-16 Executive Budget does not contain a school aid proposal. While the Executive Budget proposes sufficient appropriation authority to fund a total year-to-year increase in aid for education of $1.1 billion or 4.8 percent, there are no school aid formulas to allocate these funds.

Further, since there is no proposed school aid formula, the Executive has not released school aid runs which would normally support a school aid proposal. This has already created significant issues for school districts as they plan for their budgets.

This alleged school aid increase falls far short of the $2 billion requested by the Board of Regents, the $2.2 billion requested by NYSUT and The Alliance for Quality Education (AQE), and the $1.9 billion increase advocated by the Educational Conference Board.

School districts must comply with various law and regulations regarding tax cap calculations, which are due to the Comptroller March 1, 2015, and prepare for the school budgeting process. Without an Executive Budget proposal, districts will be simply guessing at a number to comply with their statutory requirements.

In addition, any increase in school aid is tied to so-called "reforms" that would harm students, educators, and the communities they serve. If these harmful "reforms" are not implemented, education funding would be limited so that no district would get any increase in school aid, decreases in school aid are actually possible.

Because there is no School Aid formula, there is no way to decipher any apportionment between formula funding, restoration of the Gap Elimination Adjustment (GEA) and expense-based programs. There is no way to begin the school budgeting process. There is no way to comply with the tax cap law and prepare tax cap calculations.

Further, the state aid formula does not account for any enrollment growth. Alarmingly, approximately 53 percent of school districts are still at or below 2009 State Aid levels – this is even before adjusting for inflationary increases. This is true even though many school districts are experiencing enrollment growth. In the 2014-15 school year alone, 271 school districts are reporting an increase in enrollment of over 23,000 students. Many of these new students are entering high need, low wealth school districts, like Buffalo, Rochester, Hempstead, Roosevelt, Troy and Mt. Vernon, which are reliant on state aid.

Unfortunately, state Comptroller Thomas DiNapoli just identified 90 school districts in fiscal stress, up from last year's 87. The regions with the highest number of school districts in fiscal stress include: Long Island (19 districts), the Capital District (12 districts), Western New York (12 districts), the Southern Tier (11 districts), and Central New York (11 districts).

And over the course of the last six years, our students have lost tens of thousands of educators in New York's schools, over 10 percent of the entire teaching workforce has been eliminated, those who would have been assisting student learning. New York's schools are still reeling from the multiple years of school aid cuts imposed upon them. These cuts have caused class-sizes to balloon, decimated course offerings and after-school programs, particularly music, art, and physical education, curtailed academic support for at risk children, eliminated counseling services, and rolled back early childhood programs including full-day kindergarten and pre-kindergarten.

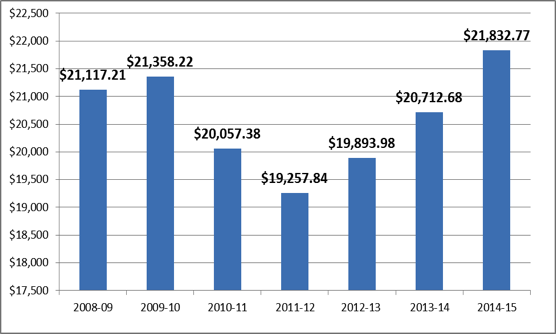

CHART: Formula Aid - Recent History (amounts in millions)

Had New York State merely increased state aid by the rate of inflation over these five years, districts would have $2 billion more to support students and programs than they have today. Furthermore, under the court ruling in the Campaign for Fiscal Equity lawsuit, coupled with the GEA, New York's public school children should have over $5 billion more than they currently do.

The State must also adequately support English language learners (ELLs). School districts across the state have seen a large increase in ELLs, including the recent influx of unaccompanied minors and refugee children. State aid, however, does not provide districts adequate or additional resources to meet the needs of these children. The state should modify its operating aid formula to better recognize the numbers and unique needs of all ELLs, as supported by the Board of Regents.

According to the U.S. Office of Refugee Resettlement, New York's schools are serving more than 6,000 unaccompanied minors. These unaccompanied children have been welcomed into our schools, however no funding for their education or related services have been afforded to their school district, and many districts are without adequate space for new students and need further services. Long Island alone is now home for 3,000 unaccompanied minors. This should be addressed in the State budget process.

We thank the more than 80 legislators, led by Member of Assembly Catherine Nolan, Chair of Education and Senator Kevin Parker, who signed a letter backing our support for a $2.2 billion increase in the budget. To begin to repair the damage wrought by painful budget cuts, sufficient funding must be targeted towards New York's classrooms to help schools reverse years of classroom cuts and make the real investments that students and teachers need.

The $2.2 billion request would constitute a meaningful down payment towards restoring the $5 billion still owed to New York's students.

Protecting our Students from Over-testing

There is nothing more important than protecting our students from over-testing, and testing solely for accountability purposes.

New York's over-reliance on standardized tests continues to have a negative effect on our students. Teachers, educators and parents are united in our concern that excessive state standardized testing is harmful for our children, and takes important time away from learning and instruction.

In order to prepare students for mandated assessments, and for tests used solely for accountability purposes, much of classroom time is spent in test preparation and in testing conditions. Often times, students are foregoing academic enrichment activities, such as art and music, to spend more time preparing for tests.

Standardized testing is not an accurate reflection of student learning. Classroom educators and parents are the best judge of student learning and there must be a greater emphasis on all that happens in the classroom to promote learning. Education priorities need to be recalibrated to emphasize teaching and learning, not more standardized testing. Over-testing erodes learning time and is directly counter to what parents and teachers have been saying: Students are not a test score.

We must also reconsider the balance between tests to hold schools and educators accountable and tests to help educators diagnose strengths and needs of individual children.

New York must address the most pressing issue facing our students - more time for teaching and learning, and less time for testing. We must address:

- the number of tests students are required to take – especially in early grades;

- how much time students spend taking tests – both the number of days and the length of time; and

- the need for timely assessment feedback and more transparency in limited standardized testing in order to identify areas where students may need extra help.

More time must be devoted to teaching and learning - not testing - and we continue to call for an end to student participation in field tests, and support districts opting out, and a parent's right to opt their child out of standardized testing.

Students are more than a test score, and our education policies must reflect that.

Attacks on Teacher Evaluation

Teachers support fair and collaborative evaluations, to assist in their professional development and learning in support of their students.

Unfortunately, the Governor believes – incredibly – that it's a good idea to put more stress on our students by placing more emphasis on developmentally inappropriate and problematic Common Core aligned standardized exams.

Governor Cuomo pushed for a rushed implementation of the new Common Core Standards, including testing students on the new standards before teachers were given a curriculum or support for teaching the new standards. He is now unfairly blaming teachings for students' low scores, and wants to double-down on the weighting of those same Common Core tests in teacher evaluation; leading to severe stress on students, an increase reliance on testing, and unfairly holding teachers and principals accountable for factors that are beyond their control.

We thank the legislature for acknowledging the severe problematic nature of these new exams, by prohibiting their inclusion on students' permanent records and preventing districts from using these exams scores as the sole reason for placement decisions.

We also thank the legislature for your support and commitment to a fair evaluation system, and for passing the Governor's safety net legislation to protect teachers from the unfair use of these same problematic exam scores. This action was well supported by research. The American Statistical Association and other well-regarded experts continue to warn against the use of high-stakes students testing as a basis for educator employment decisions.

But now, just a few months later, the Governor wants to drastically change the components of the teacher evaluation system, remove local control and use of local assessments, and base 50% of an evaluation on the same state test score you so appropriately attempted to limit. The Governor also wants to mandate that observations be conducted by an "independent observer" – someone with limited, or no knowledge of the workings of a K-12 school system, with no knowledge of what our students need.

Under his proposals, 85% of a teacher or principal's evaluation would be based on an unreliable and invalid test score, and an observation made by a complete stranger to the actual operation of a public school.

Teacher ratings established in this manner would be essentially random, and local school administration would have almost no role in judging teacher effectiveness.

Worse yet, the Governor's proposal requires teachers to receive an effective rating on both the double-down Common Core standardized test measure, and the outside observation component to be labeled as effective, and would be completely unworkable for smaller school districts with only one or two classes per grade level.

However, we DO need to change APPR. New York schools needs MORE local control, not less. New York should not continue to use a pseudo-junk science, unreliable, untested, and not understandable state growth score to evaluate our educators.

In development with teachers from across the State over these past two years, we will offer a revised evaluation system, for discussions with the legislature and our other educator colleagues, which focuses on true local control and accurate assessments of student learning and teaching development.

All teachers support a strong and fair system of evaluation, which can improve teacher practice and improve student learning. We look forward to working with our colleagues in the education community to see that this is achieved.

Attacks on Tenure and Due Process

The Executive Budget attacks tenure and due process for all new teachers; new teachers must remain in probationary status until they receive five consecutive effective or highly effective ratings on their APPR – a near impossible feat under this unreliable and variable APPR system.

The current probationary period is three years, with an option to extend for one year, with tenure decisions made by the Board of Education upon recommendation by the superintendent.

Under this proposal, a teacher who fails to meet this five-year requirement must remain on probation until they achieve five consecutive years as effective or highly effective. It is beyond absurd to solely rely on the State's APPR system, and its unreliability this way.

The Executive budget also attacks the basic tenets of due process for teachers, amending the 3020-a process for teachers unreliably labeled "ineffective" based on the state Common Core exams, creating a dangerous presumption against dedicated teachers and principals. This proposal also removes all discretion in decision making of hearing officers.

What exactly is tenure and due process for educators? Due process is nothing more than the right to know charges in a 3020-a proceeding, the right to see, confront and rebut evidence, the right to an impartial decision maker, the right to counsel, and the presumption of innocence until "proven" guilty. Due process and tenure are NOT a job protection for life.

At a time when the Governor's harmful austerity policies and public demonization of teachers has driven down teacher morale, these policies would only drive more good teachers out of the profession.

This due process attack is based on a disingenuous campaign against school teachers, one which ignores the reforms enacted by the Legislature in 2008, 2010 and 2012, and which relies on the myth that tenure is a job for life.

These so-called reforms are a politically motivated attack against every dedicated teacher in New York state. We welcome the opportunity to expose the many lies and misrepresentations about tenure and establish, once and for all, the plain truth: Tenure is an absolutely necessary safeguard for teachers, for students and for quality public schools.

Due process means teachers can speak freely and strongly on matters of public concern, and ensures that teachers have the freedom to teach effectively and the liberty to oppose policies or cuts that harm students. Teachers can partner with parents against inappropriate standardized testing and question Common Core precisely because they don't have to fear reprisals for doing so. Tenure guarantees that caring and dedicated educators can continue to advocate with parents for what's best for students.

When allegations of incompetence or misconduct arise — against a teacher or anyone else — such allegations shouldn't be automatically assumed to be true. Rather, evidence should be carefully and quickly examined, and then ruled on impartially. Due process is the foundation of our judicial system. Similar safeguards are in place to ensure police officers, firefighters and other public servants at the state and local levels cannot be arbitrarily dismissed based on allegations alone, or for politically motivated reasons.

These changes to tenure and due process – making tenure near impossible to achieve and harming the ability for an educator to defend themselves against possible false charges – are an assault on public education and on working people by those who stand to profit from privatizing public schools.

Pre-Kindergarten Expansion for Three-Year Old Children

Unfortunately, the Executive Budget fails to expand pre-k for four-year olds across the state, and no further increase in funding was provided for pre-k for four-year olds in 2015-16.

Further, the state should pay for the real-time cost of pre-k programs, as opposed to the current one-year lag reimbursement process. Districts cannot afford to continue to front funds for necessary and critical programs, particularly when districts must budget under the onerous tax cap and tax freeze laws. Providing one-time funding upfront for pre-k and full day kindergarten would be an appropriate use of the over $5 billon settlement fund.

The Budget includes $25 million to expand half-day and full-day pre-kindergarten programs to three-year old children in high-need school districts, and $3 million to support the QUALITYstarsNY, to create a quality rating system for early childhood program. These funds are allocated from unused funds from prior competitive grants.

We fully support continued investment in full-day universal pre-kindergarten, and must support full investment for full-day kindergarten for every child. Unfortunately, during this Governor's tenure, some of our neediest districts, such as Poughkeepsie, have had to cut full time pre-k and kindergarten.

Quality full-day pre-k opportunities lead to better outcomes in the academic and social development of children. Studies show that these programs increase graduation rates, reduce retention in grades, increase reading and math proficiency, and increase college participation and completion. The social and economic benefits are also striking. Quality pre-k experiences for children significantly reduce juvenile arrests, lower criminal activity, reduce teen pregnancies and result in healthier lifestyles.

Career and Technical Education

We must continue to support, and expand access to critical Career and Technical Education (CTE) programs. For many students, CTE offers the most promising pathway to career success, and we are pleased that students now have a 4 and 1 pathway to graduation.

Now, funding and reimbursement structures, particularly BOCES and Special Services Aids, need to be improved to expand programs and student access, and to facilitate broader investments and public-private partnerships in these areas, as supported by the Board of Regents.

The current aid formula for BOCES CTE programs has not changed since 1990; the state only provides aid for the first $30,000 of a BOCES instructor's salary. This has the effect of reducing state support for CTE programs and shifting the costs to local schools, resulting in the underinvestment of high-quality programs that provide students with the skills employers demand. According to the SED, more than 90 percent of CTE students graduate with a Regents diploma, some with Advanced Designation.

Therefore we fully support A.3885 (Nolan), increasing the aidable salary for all CTE programs and increasing Special Services Aid for the Big 5 City school districts, which will significantly improve CTE services and programs to students.

Community Schools

Unfortunately, the Executive Budget fails to increase funding to community schools, at a time when over 50 percent of New York's students qualify for free or reduced priced lunch.

Community schools are neighborhood public schools that address the needs of students in a holistic way — not just their academic achievement, but their overall health and well-being. Using the school as a hub, community schools integrate services, coordinate with partners and use existing government funding to meet students' academic, enrichment, social and health needs — removing barriers to learning and helping students succeed.

Typical wraparound services of Community Schools go beyond health and dental clinics, extended school hours and counseling. They include partnering with local food banks for in home food delivery, family fitness programs and even financial literacy instruction. Connecting with parents and making them feel welcome in school is crucial, whether its providing them with legal services, counseling or healthy living programs.

Importantly, funding for community schools should be on a need basis, as opposed to competitive grants the State has previously enacted, as dozens of Community School grant applicants were denied funds and support in previous years.

Charter Schools

The Governor proposes to raise the charter cap by 100, to a total of 560 charters, and would remove regional restrictions to allow remaining charters to be located anywhere in the state. This is over a 20% increase in allowable, privately run, charter schools.

He further proposes when an underperforming charter closes, their charter could then be used by another school and it not count towards the state cap. Additionally, the Executive Budget proposal increases charter per-pupil tuition by $75 per student over and above the increase that was previously allocated in the 2014-15 State Budget, for two years.

This increase would severely burden sending school districts, especially without any school aid increase, as it must be paid by sending school districts upfront, then reimbursed by the State on a year lag. Further, because of the undemocratic and unconstitutional tax cap, school districts will be required to carry this burden, likely by eliminating programs and services for students.

The Budget includes essentially unenforceable language which purports to ensure charters are teaching their "fair share" of high needs populations, including ELLs, students with disabilities, and students that qualify for free and reduced price lunch. However, similar provisions are already in statute and are currently failing. Charters are supposed to submit enrollment rates to SED for these students, at the beginning and end of each school year, during the five-year period in between reauthorizations. Also during reauthorization, either SED or SUNY is supposed to consider any pattern of noncompliance with stated enrollment targets when making its renewal decision.

If charter operators are going to continue to claim an increasing share of public school funding, they must be willing to submit to rigorous fiscal and performance audits, should accept a representative student population, and must stop wasting resources on expensive union avoidance campaigns.

Further, the Executive Budget allows the children of charter employees priority access to charter school enrollment, without use of the lottery system.

At a time when New York schools are struggling, with the majority still receiving less school aid than six years prior, charter schools are awash in a sea of horded public cash.

A recent report by the Center for Popular Democracy (CPD), estimates that charter school fraud has cost New York taxpayers $54 million this school year alone. The report notes, "Despite the tremendous investment of public dollars, New York has failed to implement a system that adequately monitors charters for fraud, waste, and mismanagement." A 2010 NYSUT analysis revealed dozens of examples of fraudulent mismanagement of public funds and showed that if we met the current statutory cap of 460 charters, state and local costs would reach year-to-year recurring costs of over $2 billion.

The legislature should summarily reject any charter per pupil funding increase, as New York's charter schools are flush with cash; such cash grow rapidly. The over $282 million in cash held is up $40 million from 2012, when charter schools reported having $221 million cash on hand. Also, unrestricted net assets held by charters grew from $298.5 million in 2012 to $392.1 million in the audits filed in 2014.

Further, recent analysis shows 82 percent of the state's charters hold, on a percentage basis, cash in 2013 well in excess of the 4 percent that traditional school districts are permitted to keep in the bank. The 184 schools studied had, on average, 25 percent of their annual budgets in cash reserves – six times what regular public school districts are permitted to hold.

Clearly, the charter industry's push for additional per pupil and facilities money is undermined by their own financial accounting which shows the current funding formula is more than adequate to meet their needs.

We will be supporting a series of reforms, to ensure charter accountability and transparency, and to provide necessary safeguards for students attending these schools.

State Take-over of Schools

The Governor also proposes state takeover of public schools, whereby SED would have the ability to appoint a receiver to oversee a "failing school or district," possibly leading to the mass privatization of our public schools.

Such "receivers" could be either a not-for-profit entity, another school district or school entity, or an individual, whose powers would override local superintendents and elected boards of education. These entities could have little, or no experience in the K-12 setting, and could incredibly be private entities intending to privatize our public schools.

The receiver would have the ability to dangerously negate and change curriculum, fully eliminate professional development, replace "unqualified" teachers and administrators, allow merit pay, override and negate collective bargaining agreements, supersede any decision of the superintendent or the board of education, including hiring and firing, and remove all seniority rights.

The receiver would be specifically authorized to abolish all teaching and administrative positions in a school building.

This legislation is absolutely unnecessary, eradicates local control, and procedures like this have previously failed. The state has attempted to take-over public schools, with absolutely no success.

Disrespect for collective bargaining agreements and worker rights is not the New York way. New York's constitution specifically protects such rights, and it is disheartening that the Governor so cavalierly disparages them.

Master Teacher Program Expansion

The Budget includes $5 million to expand the Master Teacher program. Expansion includes increased eligibility to licensed English as a Second Language or bilingual education teachers. Further, eligibility is extended to include teachers who have dual certifications in special education and general education.

We continued to be deeply concerned over any proposal to impose "merit pay" on schools, where teachers would be pitted against one another in a high-stakes monetary game. Tying pay to a rating system that was undermined by the terribly flawed roll out of Common Core is problematic, especially when student growth data on new Common Core assessments is being used in the evaluation process.

Educational researchers have found a number of significant weaknesses in merit pay programs, and no study has shown with any degree of conclusiveness that merit pay improves the overall quality of instruction. It has also never been shown that students benefit from merit pay.

Research has shown that merit pay promotes competition among teachers and destroys cooperative efforts to reach common educational goals. Any system that creates a competitive, rather than collaborative, school climate raises real concerns.

Career ladders, however, would be an appropriate use of these funds. Extra pay for other assignments, such as mentoring new educators or working on advanced degrees and professional development should be negotiated with teachers through local collective bargaining.

Back-door Voucher Proposal

The Executive Budget would establish a back-door voucher program, also called the Education Investment Incentives Tax Credit (A.2551, Cusick and S.1976, Golden).

This proposal is nothing more than a tax giveaway to the wealthy. Corporations and individual taxpayers would be able to receive a tax credit equal to 75 percent of their authorized contributions, up to a maximum annual credit of $1 million.

The Governor's proposal would divert $300 million away from public schools, services and the General Fund – monies that should be supporting public schools and other public services.

Worse yet, this legislation does nothing to help low wealth, high-need students, or middle or low-income donors. Rather, it would allow the wealthy to avoid their tax liability while withholding the taxes they owe to support the public good.

New York's public school children are still owed $4 billion under the Campaign for Fiscal Equity lawsuit and $1 billion under the Gap Elimination Adjustment. How can hundreds of millions of dollars in tax giveaways to the wealthy be justified when our public schools and students are still struggling and the state is not funding the sound basic education that its own constitution requires?

The introduction of this proposed scheme would create an annual funding battle between public and private schools, and a never-ending debate over expansion of such credits.

The state Constitution also prohibits direct or indirect financial aid to private schools that are under the control of a religious denomination or where religious tenets are taught and mandates an adequately funded public school system. Private schools, their curriculum, and their funding structures are a choice. Public education is a constitutionally mandated function of state government, obligated to serve all children and accountable to all voters.

Further, the establishment of this back-door voucher scheme is contingent on passage of the unrelated DREAM Act; an attempt to extort passage of this tax giveaway to the wealthy.

Tax Cap

The Executive intends to make the tax cap permanent, without any meaningful public review of its impact on schools and municipalities. Further, the tax freeze exacerbates the unfairness of the tax cap, by further punishing districts for events beyond their control.

Its impact continues to pose great impediments to local school boards in meeting their obligations to successfully educate every child. The 2015-16 allowable tax levy for schools is a mere 1.62 percent. This devastatingly low percentage will have serious negative effects on our students and their schools.

Living under a tax cap, most districts have been unable to turnaround the disinvestment in classroom services. Without significant additional aid, and a reasonable adjustment to the tax cap for costs beyond their control, many school districts will lack sufficient resources to fund current programs. The Governor's tax cap and freeze perniciously hurts our poorest districts the most, placing the most severe limits on their ability to raise funds, and punishing parents and other taxpayers in low-wealth districts who try to provide more funding for their children.

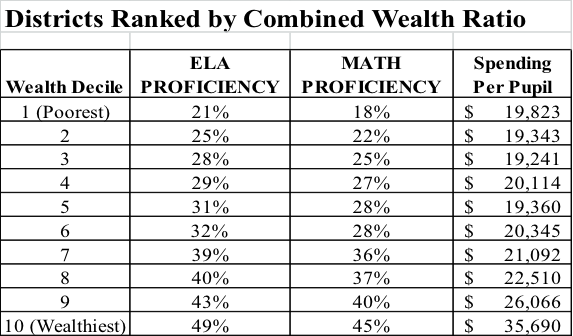

CHART: IMPACT OF TAX CAP ON PERFORMANCE

The tax cap is set to expire in 2016, however its continued enactment is tied to the passage of New York City rent control, which is set to expire in June 15, 2015.

NYSUT has long advocated for reforms including removing the supermajority provisions, and including necessary exemptions to make the tax cap less onerous. Further, we are deeply troubled by the undemocratic 60 percent supermajority requirement in terms of its disparate impact on low-income and high-minority school districts.

Enrollment growth must be included as an allowable exemption from tax cap calculations, as many districts across New York have seen a surge in enrollment, with no funds to support those children and no ability to levy further taxes for programming. Further, BOCES capital projects should be fully excludable from the property tax cap like their district counterparts. Other necessary exemptions include costs for upgraded school safety and costs outside of a district's control.

Preschool Special Education (4410 programs)

The Executive Budget establishes regional rates for Special Education Itinerant Teacher (SEIT) providers. SEIT providers are currently reimbursed based on their historical costs. The Budget alleges that by establishing regional rates, the current payment structure will "rationalize … by ensuring that all providers within a region are paid the same amount for providing these services." The regional rate will be implemented over the next four years.

Unfortunately, 4410 programs have seen significant shortfalls, and providers will likely need to continue to rely on short-term borrowing until proper reimbursement is made. There continues to be uncertainty in funding for 4410 programs, and funding to these programs must be increased to support the actual need of students.

4201, 853 and Special Act Schools

There are no proposals in the Executive Budget for increased support for 4201, 853 and Special Act Schools. We continue to thank Senator Flanagan and Members of Assembly Nolan and Meyer for their work on this issue.

For the past two years, special act school districts and 853 schools received an increase of three percent and 3.8 percent respectively. However, the three percent increase was applied only to direct care and excluded costs such as rent, utilities and administrative costs. While 853 and special act schools have received a modest increase in funding, the many years of stagnate funding continue in the face of increased costs, endangering the future of these institutions.

Further, several special act school districts have been forced to close and others continue to face serious financial situations, and 4201 schools - which serve students with disabilities with deafness, blindness, severe emotional disturbance or severe physical disabilities - did not receive the same modest increase in funding as special act school districts and 853 schools previously did.

Specialized schools do not receive typical school aid increases that public school districts and their students benefit from, and these institutions have no taxing authority. Students attending these schools have specialized educational needs that cannot not be served in another setting. They are the neediest, and often forgotten. We must ensure that they receive adequate support so they can better plan and prepare for the future without the worry of financial insolvency. As you move into budget negotiations, we urge you to remember these schools and students and provide them with a funding increase (percentage) on par with that for our traditional schools.

Extend Education Services for Children in OMH Hospitals

The Executive Budget would amend a pilot program providing school age children currently residing in OMH Hospitals with specialized educational program aligned to their home school district curriculum.

BOCES would be authorized to provide students with any educational service that is being provided to their home component school districts, and we support this proposal.

Teacher Centers

Teacher Centers were established by the state Legislature in 1984 to provide comprehensive, ongoing professional development and support services to our teachers. They are the only state-funded vehicle guaranteed to support teacher professional development in all school districts, including 205 high-need schools/districts, BOCES, non-public and charter schools.

The Executive Budget fails to fund these critical centers for educators for the 2015-16 school year. Funding for Teacher Centers has not met the demand for continued and increased professional development for our educators. For example, the 2014-15 school year funding level for Teacher Centers ($14.26 million) is less than it was almost twenty years prior. Funding should be restored to at least its 2008-09 levels of $40 million.

Teacher Centers support programs that ensure educators are exposed to emerging techniques, practices and technologies to be increasingly effective in the classroom and help close the achievement gap. They also offer courses and programs that enable new teachers to satisfy certain professional requirements.

Many centers are using a highly effective coaching model to aid teachers in understanding the Common Core standards and how they intersect with the NYS Learning standards, including alignment with the State-issued curriculum modules.

Teacher Centers upstate are supporting educators implementing the Common Core with strategies to differentiate their instruction and adapt to the poverty that many of their students experience. On Long Island, centers are providing professional learning that addresses a specific area of need identified, such as algebra. Other centers throughout the state are conducting regional forums that promote family engagement with the Common Core and its requirements, while other centers have begun working with local higher education institutions to better prepare teacher candidates for the Common Core.

Teacher Centers are also economic engines for the state. These centers have run the most successful public/private collaborations in education because they bring high-quality resources to Pre-k-16 institutions. They maximize resources and leverage existing purchasing agreements to provide significant savings to property taxpayers. These centers work with many colleges, universities, museums, youth bureaus, early childhood agencies and workforce investment boards. They also collaborate and partner with corporations like Microsoft, Apple, Adobe, Verizon, Google, and Dell. They have brought in over $36 million in additional private contributions through grants, business and industry collaborations.

At a time when we are asking educators to comply with higher learning standards to ensure all students are on track for college and career readiness, we must first provide educators with the resources and tools they need to meet this demand.

Special Education Mandate Relief

The Executive Budget would allow districts, BOCES and approved special education providers the ability to petition the State Education Department for flexibility in complying with certain special education requirements.

We oppose this proposal, as it would allow the erosion of needed protections for our most vulnerable students.

The legislature has already made strides in providing mandate relief for students with special needs. Recently, the legislature authorized school districts the option for a teacher to have access to a student's individual education program (IEP) electronically and further, in NYC, by automatically eliminating a parent member on the Committee on Special Education (CSE).

The enactment of a waiver to current statutory and regulatory special education mandates could erode the quality of education for these students and diminish the protection these necessary mandates provide.

We urge that the legislature reject this provision, as it has for the past several years.

Conclusion

Public schools are not a monopoly to be broken. Rather, public education is the centerpiece of our democracy and a ladder to opportunity and success for all New Yorkers. Our public schools are transparent, accountable and democratically governed by locally elected school boards directly accountable to voters. Proposals by the Governor are an attempt to centralize power and privatize public education, stripping away local control from parents and their local, democratically elected school boards.

NYSUT looks forward to partnering with the Legislature to ensure our students receive the necessary resources and programs for a 21st century high-quality education, in order to prepare them for college and career readiness.

There is nothing more important than investments in our students and their future, and no better return on this investment than to provide the best possible education for all school children to enable them to succeed.