Legislation in New York seeks to make the state’s property tax cap permanent.

The state property tax cap would continue to be tied to the previous year’s average monthly Consumer Price Index, or 2 percent, whichever is LOWER.

This is an arbitrary and inadequate way to address school funding. It’s unfair to taxpayers, it’s undemocratic and it hurts students, especially in higher-need, lower-income districts.

Here’s why starting with how it affects students:

It hurts students because school children are denied educational resources and opportunities based on the relative taxable wealth of their school districts. Poorer districts are unable to raise as much education funding as wealthier districts.

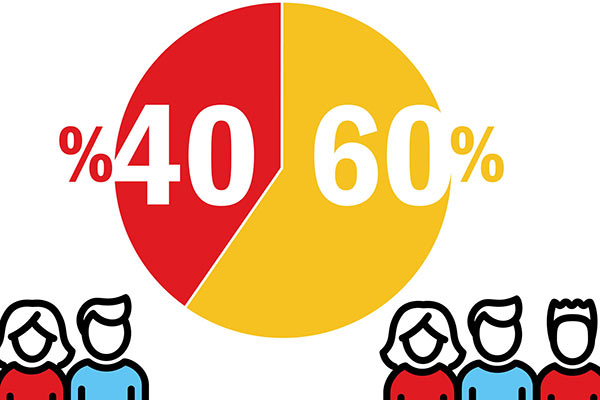

The current law is undemocratic because it requires a supermajority on votes for school budgets seeking to increase the school funding tax levy by more than 2 percent or the rate of inflation, whichever is less. Why should a minority of 40.1 percent of voters be able to overrule a majority of 59.9 percent? Democracy calls for one person, one vote, not minority rule.

It’s unfair to taxpayers because it ties tax bills to property value, rather than the ability to pay. In other words, if your income drops for some reason beyond your control, your income tax liability reflects that. Your property tax bill, however, remains the same, despite the fact you can no longer afford it. Tying school funding to property taxes without including some consideration for income and ability to pay hurts property owners and does little to address overall school funding issues.

The better way to adequately fund public education is through a “circuit breaker” program, which would provide targeted tax relief based on one’s ability to pay. Circuit breaker programs kick in when too much of a taxpayer's income would be spent on property taxes. The circuit breaker reduces the overload.

Circuit breaker programs reduce the property tax burden only of low- and middle-income families so they're much less expensive for the state than across-the-board tax cuts.

Instead of making permanent a program that is unfair, undemocratic and hurtful to students, lawmakers must consider a plan that provides taxpayers relief when they need it and adequately funds education for all New York students.