Testimony of Andrew Pallotta, President, New York State United Teachers, to the Senate Finance Committee, Liz Krueger, Chair, and Assembly Ways and Means Committee, Helene E. Weinstein, Chair, on the Proposed 2019-20 Executive Budget for Elementary and Secondary Education. February 6, 2019.

Chairperson Krueger, Chairperson Weinstein, honorable members of the Legislature and distinguished staff, I am Andrew Pallotta, President of New York State United Teachers (NYSUT). NYSUT represents more than 600,000 teachers, school-related professionals, academic and professional faculty in higher education, professionals in education, in health care and retirees statewide.

Thank you for the opportunity to testify today on the proposed 2019-20 New York State Executive Budget for Elementary and Secondary Education. I am joined by Michael Mulgrew, President of the United Federation of Teachers.

The state of public education in New York is improving. Just last week, the State Education Department released wonderful news, the graduation rate for students statewide had increased yet again, to 80.4 percent. Increased graduation rates across the state show that when we invest in our schools, we are investing in our students and their futures. Full funding of our schools is an investment not just in the short-term outcomes of our students, but in the long-term future of our entire state.

We must continue to advocate for greater investments in state education to maintain this progress and help more of our students earn a high school diploma.

We must continue to work towards reducing unnecessary testing in our schools.

We must also restore the joy of learning and teaching to our classrooms.

School Aid

The executive budget provides a year-to-year increase of $956 million, or approximately 3.6 percent in overall support for K-12 education, of which $338 million is provided for Foundation Aid (of which $50 million is a community schools set-aside). Considering the $50 million set aside for community schools, the Foundation Aid increase is only $288 million (1.6 percent).

While the proposed increase of $956 million is appreciated, it is not enough to maintain current academic programs and services and provide the proper level of investment to ensure that all students receive a high-quality education.

More school aid will be needed in the enacted budget to support existing services. Both the Board of Regents and the Educational Conference Board have called for additional funding for public education.

School districts require more state funding. A total increase of $1.7 billion ($1.3 billion in Foundation Aid and $409 million to fully fund expense-based aids) is needed to begin a three year phase in for Foundation Aid and to fund existing commitments to expense based aids.

Increasing Foundation Aid is particularly important, and an increase of $338 million, which reflects less than a two percent increase in Foundation Aid, is simply not enough. This aid is distributed via a formula that incorporates the cost of educating a student, the needs of students within each district, variations in regional costs and the district’s local ability to support the cost of educating its students.

NYSUT urges the Legislature to provide this level of funding and, as the Educational Conference Board has recommended, provide an additional $500 million in targeted funding to: strengthen school safety, provide mental health services for students and improve school climate; provide continued support for struggling schools; increase the funding to meet the needs of English language learner students; offer high-quality professional development; and expand access for college and career pathways.

Public schools remain the best investment our state can make. We urge the Legislature to continue to make the necessary investments in Foundation Aid to build on the progress that has been made in recent years.

This year in particular, state support for schools is critical, as the tax cap is set at two percent. The tax cap will continue to impede local school districts’ ability to raise revenue, while school districts grapple with greater, more intense student needs and increased mandatory costs. Under this year’s tax cap, only $400 million can be generated locally by school districts state-wide. Moreover, when you consider that on average, only 38 percent of a school district’s funding comes from state aid, this places an even greater importance on state school aid, as it is an integral source of revenue for many school districts.

Foundation Aid Formula

With respect to the Foundation Aid formula, NYSUT calls for a real commitment to fully-fund the Foundation Aid formula within three years. We also support conducting a new cost study based on current data to determine the amount needed to provide students with an education that prepares them for the future. NYSUT would also support updating the formula weightings for poverty, disability, enrollment growth and English language learners. We should also examine how the wealth factor is adversely affected by temporary, drastic changes, such as when a resident of a school district receives a large inheritance or receives lottery winnings.

Schools are implementing new learning standards, planning budgets (with restrictions on local revenue in the form of the tax cap), providing increased services for English language learners and striving to establish additional pathways to college and careers. Therefore, the regional cost index should also be reviewed, as economic factors in different areas of the state have likely changed since the formula was enacted.

Again, NYSUT believes that adequately funding the Foundation Aid is the best vehicle to address the needs of all public school students.

School Spending Reporting and Funding Equity

We urge you to reject the executive budget proposal that would require school districts to re-allocate up to 75 percent of their Foundation Aid increase, in certain instances, to specific schools within a district. This proposal does not address the real issue that many school districts are facing – a lack of adequate funding. This lack of funding stems from the property tax cap.

NYSUT urges you to reject this proposal and keep control in the hands of the local community.

Expense-Based Aids

NYSUT is appreciative that the executive budget fully funds expense-based aids in the current year but we oppose the provisions that would merge, 11 expense-based aids (BOCES, transportation, special services, high tax, textbook, school library materials, computer software, computer hardware and technology, supplemental public excess cost, transitional aid and academic enhancement) into one category called services aid. The growth in this aid category would be tied to inflation and student enrollment growth rather than actual expenditures in these critical areas. In addition, the executive budget would also create a new tier in building aid for new projects that will reduce state funding for capital programs across the state. This proposed cap on expense-based aids would damage BOCES programs and services and reduce building and transportation aid reimbursement to districts. In addition, a school district may have to choose between busing children or shuttering programs and enrichment for students.

We urge you to reject this proposal.

School Aid Growth Cap

Another area of great concern for NYSUT is the executive budget proposal that would base the school aid growth cap on a 10-year average of annual income growth, as opposed to the current metric of annual income growth. NYSUT opposes any cap on growth because it is not connected to student needs. NYSUT believes that the State should have the ability to tackle challenges and address the needs of our students as they arise, and not be bound by an artificial cap.

We urge you to reject this proposal.

APPR

NYSUT thanks the Legislature for passing S.1262 (Mayer)/A.783 (Benedetto), which would allow educators to teach and students to learn.

Community Schools and Receivership

NYSUT would like to again thank the Legislature and governor for their commitment to, and support of community schools, which are schools that provide wraparound services for students with extraordinary needs. We know that poverty impedes a student’s ability to learn and community schools have been successful counteracting this untenable situation for so many students. These schools have succeeded in: increasing graduation rates; reducing dropout rates; closing the achievement gap; reducing chronic absenteeism (especially due to inadequate health care); increasing student participation in afterschool and summer programs; and reducing grade retention.

NYSUT firmly believes that the community school model, which provides necessary supports and services to students and their families, is the best way to turn around struggling and persistently struggling schools.

Our schools must not only provide education and instruction but must also address the social and emotional needs of our students. Social and emotional development and learning play an important role in making schools safe, maintaining a caring school climate and enhancing student motivation. We need to ensure that trained professionals, such as certified school psychologists, school social workers and school counselors are readily available in our schools to provide the appropriate clinical services to each student whenever necessary.

The executive budget contains a provision that requires school districts to set aside $250 million (an increase of $50 million) from Foundation Aid for community school conversions with significant ELL populations. NYSUT urges the Legislature to maintain the $200 million in existing community schools funding while supporting $50 million in new funding through a Community School Categorical Aid. We firmly believe funding for community schools is critically important and should supplement, not supplant, Foundation Aid.

With respect to the issue of receivership, there are currently 43 school buildings under receivership that are located in 11 school districts. They include the Big 5 School Districts, Albany, Binghamton, Poughkeepsie, Hempstead, Troy and Schenectady. Since Foundation Aid has not been fully phased-in, these districts are still owed nearly $2 billion in Foundation Aid for 2019-20.

Due to years of inadequate state funding, school districts with struggling schools that serve high poverty populations have been forced to make drastic cuts to staffing, programs and services. These decisions negatively impact both the school and students' academic performance. These schools have two common characteristics: chronic poverty and underfunding by the state.

The State Education Department recently released a list of struggling schools, many of which are schools that have been misidentified, due to penalties placed on districts with high opt-outs, and using the flawed state growth model. This type of misidentification does not address the real issues that schools are facing – the lack of adequate funding and resources.

NYSUT urges the state to repeal the receivership law. This law continues to mislabel schools, students and educators. This law also blames educators, rather than addressing the real fundamental problems that are symptomatic of these schools – high concentrations of students living in poverty and chronic underfunding. The provisions of this law attempt to privatize public education and strip away local control from parents and their local, democratically elected school boards. There is no evidence to support the argument that firing educators raises student achievement. This harmful provision in the law strongly discourages educators from working in struggling schools, as these schools serve significant high-needs populations. We should do everything we can to support our educators in these schools, not penalize them.

Tax Cap

As I have already mentioned, the two percent tax levy limit for 2019-20 will have serious negative effects on our students and their schools. This year, statewide, school districts will only generate $400 million locally to fund their programing. NYSUT urges you to reject the proposal in the executive budget to make the tax cap permanent. Similar legislation recently passed the Senate. That said, eliminating or amending the tax cap continues to be a priority for NYSUT.

Living under a tax cap has hindered most districts’ ability to restore recessionary cuts to classroom services. Without significant additional state aid, and a reasonable adjustment to the tax cap for costs beyond their control, many school districts will lack sufficient resources to fund current programs. The tax cap hurts our poorest districts the most by placing severe limits on their ability to raise funds.

Short of a full repeal, NYSUT urges the Legislature to enact the following changes to the current tax cap: remove the supermajority provision; make the cap a true two percent or set it at the Consumer Price Index (CPI), whichever is higher; exempt payments and projects related to natural disasters; exempt costs for school safety and school resource officers; exempt PILOTs to mitigate the effects of IDA decisions, which school districts have no say in; exempt court judgments against school districts; exempt tuition payments for both general and special education; exempt retirement and health care costs; exempt the cost of energy and fuel; exempt the effect of failed add-on ballot propositions; and exempt BOCES capital projects, all to mitigate the negative impacts on the tax cap on education. BOCES capital projects should be fully excludable from the property tax cap, just like their school district counterparts.

While the purpose of the tax cap is to generate savings for property owners and businesses, it has had the negative consequence of exacerbating educational inequities and defunding public education.

NYSUT agrees that property taxes are high in our state, but studies show the best way to address this issue and to adequately fund public education is through a “circuit breaker” program. A circuit breaker program would provide targeted relief based on one’s ability to pay. NYSUT believes the state should implement a circuit breaker to replace the tax cap. This, in our view, is a more progressive way of lowering property taxes in this state.

Take a Look at Teaching

I just wanted to make you aware of an initiative NYSUT recently launched called, "Take a Look at Teaching," spearheaded by our Executive Vice President, Jolene DiBrango. This initiative is meant to help address the teacher shortage, address teacher diversity challenges facing our state and highlight the benefits of a rewarding career in education.

Take a Look at Teaching is a union-led initiative to increase the number of students and career changers entering the teaching profession. It also focuses on increasing diversity in the education workforce and elevating the teaching profession as a whole.

NYSUT has begun a series of Take a Look at Teaching summits. We recently held the first two in Syracuse in Central New York and Kenmore in Western New York. The next two for this school year will be held in Rochester and Potsdam. These summits will focus on bringing the community to the table, speaking with students about their needs and experiences and changing the narrative about teaching.

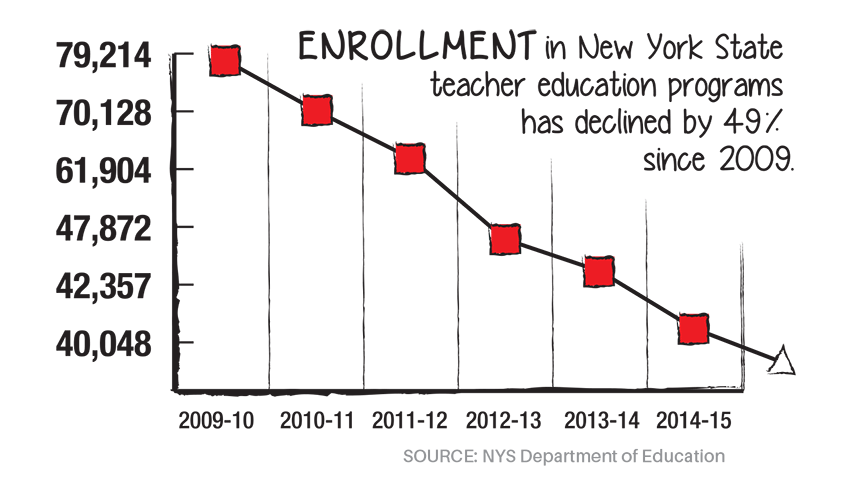

Between the years of 2009-2015, enrollment in New York teacher education programs fell 47 percent. This mirrors a national trend.

Teachers in our state and nationwide have been scapegoated and treated unprofessionally. This has had a devastating impact on dedicated educators, so much so, that many teachers are advising their own children to not enter the teaching profession.

Changes to evaluation, tenure, edTPA, GPA requirements that remove discretion and overly proscriptive edicts on teacher education, all demonstrate the lack of respect for the dedicated teachers preparing our students for their futures.

I want to take a moment to thank you for taking the first step to restoring respect and dignity to the teaching profession with your recent passage of the Mayer/Benedetto bill to reform the APPR process. This bill is extremely important for our members.

This teacher shortage is further compounded by the age of active educators. According to the 2016 New York State Teacher Retirement System (TRS) Comprehensive Annual Financial Report in June of 2015, out of a total number of active members (266,350) there were over 50,000 active TRS members over the age of 55. In addition, there were almost 35,000 active TRS members between the ages of 50-54. Based on this data, one could conclude that within the next five years, nearly one-third of the active members will be eligible to retire.

At the first two Take a Look at Teaching summits, our members repeatedly expressed the need for additional mentorship to help recruit and retain teachers.

With that in mind, NYSUT asks you to increase funding to the Mentor Teacher Intern Program (MTIP). The MTIP supports new educators by easing the transition from teacher preparation to practice, ultimately increasing the skills of new educators. The program reflects best practices in mentoring, improves teacher quality and helps bolster the educational performance of students instructed by new teachers. The executive budget proposes a $2 million program, NYSUT respectfully asks that you fund the MTIP at the pre-recession level of $10 million.

NYSUT recognizes the need to diversify the teaching profession, while also preparing the educators of tomorrow in identified subject and regional shortage areas. We also recognize the need to recruit and retain teachers. To that end, we are asking the Legislature to expand the Teacher Loan Forgiveness program that was enacted in last year’s budget to include higher education faculty and to fund the program at $10 million.

NYSUT also urges the Legislature to expand the funding available for the Teacher Opportunity Corp (TOC) to $10 million. The TOC provides grants to 16 public and private colleges in New York State to help recruit and diversify the ranks of the teaching profession while supporting students pursuing a career in education.

Charter Management Operators

I would now like to turn to the issue of charter management operators. Currently, school districts are being penalized and damaged by the state’s process for charter school tuition reimbursement.

Our traditional public schools should not be held responsible for state-mandated increases in charter school tuition payments. Low-wealth, high-needs districts are hit especially hard by the current lagged system. These schools are already struggling financially. Therefore, NYSUT calls for a charter tuition formula fix. In the recent past, the state has fully reimbursed school districts for the per pupil increase in tuition for charter schools – that is no longer the case. NYSUT urges the state to maintain its past practice and fully fund the increased per pupil tuition costs that public school districts must pay to charter schools, so that public school districts are not subsiding charter schools in their districts.

The estimated total of tuition payments made to the charter industry by public schools in 2018-19 is expected to exceed $2.25 billion, an increase of over $250 million from the previous year. However, no corresponding accountability and transparency provisions have been enacted to ensure that these public funds are being spent appropriately. The vast majority of this $250 million does not come from the state, but rather from local taxpayer revenue.

Furthermore, based on the most recent data, the charter industry’s estimated cash reserves of approximately $400 million demonstrates why the charter industry must be held to more stringent standards of accountability and transparency.

In addition, the property tax cap law treats public schools and charter schools differently. Unlike public schools, charter school budgets can increase without any public approval. The property tax cap law holds charter schools harmless but requires public school districts to provide increased funding if the charter school enrollment increases. NYSUT continues to believe it is unfair to taxpayers that the current charter school law does not require public transparency for the charter management operators that support these schools.

We oppose any new moneys going to charters, or any lifting of the charter cap, until transparency and accountability measures are enacted.

We strongly support strengthening New York State’s charter industry laws to increase accountability and transparency with regard to how students are served and how public dollars are spent. The state should impose more rigorous oversight provisions to prohibit ethical and financial conflicts for charter operators. We strongly urge the governor and Legislature to: allow audits of Education Management Organizations (EMOs) and require charter regulators and their management companies to publicly provide any and all financial records related to their schools; ensure charter schools enroll and appropriately educate English language learners, students with disabilities, students living in poverty and students in temporary housing; ensure students are treated fairly; provide more transparency and accountability in the use of state and local funds; require charters to hold the same percentage of reserves as other public schools; prohibit interest-bearing loans from management companies to charter schools; prohibit the use of public funds for advertising; provide both the New York State and New York City Comptrollers the authority to escrow the funds in real estate transactions; recoup charter school money from the New York State Education Department (NYSED) for students living outside the district; escrow funds in question when students are proven to live outside the district and make NYSED pay instead of the district in the interim; ban unrelated business income; require charter boards to be publicly elected, or have designated publically elected board seats; subject charters to the open meetings law; require a local public referendum before there is a charter approval; prohibit personnel from working for both the charter management company and a related charter school itself; prohibit any charter authorizer, or approving school board member from having any personal or professional relationship with the charter, or any charter building development; prohibit charters from using monies for private ventures; prohibit charter operators from operating for-profit companies that contract with charters; require charter school boards to establish conflict of interest and ethics policies; and require centralized charter admissions/lottery wait lists to be developed by the local public school district.

Power Plants, Tax Certiorari and Final Cost Reports

Another very important issue for NYSUT is the growing number of school districts that have been or will be affected by power plant closures. We urge the Legislature to continue to provide funding in this year’s enacted budget to ensure that school districts are fully reimbursed by the state when districts are affected by the closure of power plants, like Indian Point, or where the full valuation of a tax base has been reduced, such as in North Rockland. The Legislature has appropriated funds for school districts already facing these issues, such as Kenmore Tonawanda in Western New York, and we thank you and ask for your continued commitment to affected districts.

NYSUT urges the Legislature to expand the funding program for those additional districts that will face either power plant closures, as the state retools its electric generation capabilities, or those that have, or will, face adverse tax certiorari decisions.

I want to now speak to the perennial issues and problems surrounding penalties related to a school district’s final cost reports for capital projects.

Currently, if a school district makes a ministerial error on, or does not submit its final cost report in a timely fashion, the district is in jeopardy of losing all of its building aid from the state. This system of oversight is antiquated and unduly punitive and has caused problems in both high- and low-wealth districts.

In the end, the current system hurts students. If a district runs into problems with its final cost report, it could be forced to slash programming and resources from our children because of the harsh penalty in law. I believe this was not the intent of the Legislature.

Furthermore, the current penalty of clawing-back state aid, stemming from either a mistake in, or a late submission of, a district’s final cost report has a much greater impact on low-wealth, under-resourced school districts. These districts are not equipped to absorb the impact these penalties have on programming and resources for students. For a low-wealth district, facing the loss of state building aid is potentially catastrophic, as they would not be able to levy the taxes required to absorb the fiscal hit to their budget.

NYSUT wants to recognize and thank the governor and the Legislature for helping the North Syracuse school district in 2018. The North Syracuse school district was in jeopardy of losing nearly $30 million in state aid, or 21 percent of its annual school budget.

Currently, there are several school districts, throughout the state that have been identified as having their state aid subjected to recovery for problems associated with their final cost reports. The school districts are: Panama (Chautauqua County); Mt. Morris (Livingston County); Spackenkill (Dutchess County); Chester (Orange County); Sayville (Suffolk County); Newburgh (Orange County), Fulton (Fulton County), Port Washington (Nassau), Corning (Steuben County); and Roscoe (Sullivan County).

The Chester and Panama school districts are facing large recoveries in terms of the percentage of their overall budget. In the case of Chester, the state building aid penalty is equal to 97 percent of its entire annual school budget.

Typically, low-wealth districts take on school building capital projects only because of the promise of state building aid. Without the state’s assistance, these districts would never be able to afford these projects on their own.

Each legislative session, the Legislature finds that it must deal with a number of bills that normalize and validate final cost reports in order to save districts from losing their state aid, thereby protecting student academic programs and services.

Surely there is a better, more efficient way to oversee building aid projects by school districts without sacrificing the health and safety of those who work and learn in our schools, while still maintaining strict fiscal controls.

NYSUT urges the elimination of any fiscal penalty to a school district stemming from ministerial errors associated with final cost reports.

Teacher Centers and National Board Certification

I would now like to turn your attention to programs that improve teacher quality and support vital professional learning initiatives that ensure all educators have the resources, mentoring and support needed to help students learn in the classroom.

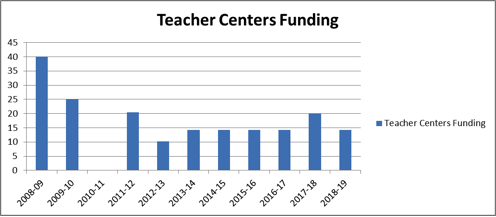

The executive budget eliminates $14.26 million in funding for Teacher Centers. Teacher Centers are the only state funded vehicle guaranteed to provide comprehensive, ongoing professional development and support services to educators and school-related professionals in all school districts, including more than 200 high-needs districts, BOCES, non-public and charter schools. We respectfully request funding be restored to its 2008-09 level of $40 million.

*n.b., In 2010-11, Teacher Center funding was eliminated.

Teacher Centers have demonstrated that they are the most cost effective way to deliver relevant professional development programs to teachers and school-related professionals. They are required to annually survey the educators they serve to ensure that what they offer aligns with what is needed locally.

Teacher Centers combine locally-determined professional learning with their historical mission of promoting the use of technology in the classroom, including the provision of much-needed support for STEM programs and Smart Schools initiatives.

Some of the many teacher center program highlights include:

- offering educators sustained programs, individual workshops and direct access to researchers to promote the creation of safe, secure and supportive learning environments for all students;

- offering professional learning experiences that expand the potential teaching assignments of special educators, helping all districts with their special education programs;

- providing poverty simulations that equip educators and promote a better understanding of the effects of poverty, while also providing educators with instructional strategies designed to engage impoverished students;

- supporting individual teachers, schools and districts with the integration of educational technologies so that teachers know which programs they can access and which programs align best with their students’ needs;

- offering professional learning sessions for all educators who work with English language learners (ELLs) at all grade levels and all levels of English proficiency; and

- delivering professional learning in ways that make sense to educators; sessions are held where the educators are, in their classrooms and schools, or online when they can be more easily accessed, or a combination of onsite/online. This is especially beneficial for rural districts in need of high-quality professional development.

The executive budget funds National Board Certification, the highest credential in the teaching profession, at $368,000. The impact of National Board Certification on student learning, school climate and teacher effectiveness continues to be confirmed by numerous research studies. National Board Certification is a highly respected, professional, voluntary credential that provides numerous benefits to teachers, students and schools. It was designed to develop, retain and recognize accomplished teachers and to generate ongoing improvement in schools by enhancing teacher effectiveness and supporting improvements in teaching and learning.

In 2017, for the first time since the inception of this program, educators were denied participation in National Board Certification because funding was exhausted. We urge the state to expand the number of teachers who can participate in this program. We ask that funding be increased to $1 million to enable more educators to take advantage of this highly-effective certification program.

4201, 4410, 853 and Special Act Schools

NYSUT continues to strongly support the missions of 4201, 4410, 853 and Special Act schools. We call on the state to work towards achieving educational funding parity with our school districts. Specifically, we urge the Legislature to provide regular, predictable increases in their tuition rates. NYSUT is also appreciative of the $30 million capital fund provided for in the executive budget for 4201 schools that serve the deaf and blind, and we would urge the Legislature to increase that amount and include 853 schools, Special Act schools and 4410 programs.

Specialized schools have no taxing authority, nor do they receive typical school aid increases that benefit public school districts and their students. Students attending these schools have specialized educational needs that cannot be served in another setting. We urge the Legislature to ensure that these schools receive adequate support so they may better plan and prepare for the future without the worry of financial insolvency. As you move into budget negotiations, we urge you to provide all of these schools with a funding percentage increase that are on par with that of our traditional public schools.

We also strongly support the provision contained within the executive budget to provide $17.2 million for increased salaries for staff in 4201, 4410, 853 and Special Act schools.

Direct Care Workers

NYSUT urges the Legislature to include a living wage for those who work directly with, and care for, our students and children with disabilities, in other not-for-profit agencies, such as Abilities First in the Dutchess county, Aspire in Erie County and Oak Hill in the Capital region. We believe, that as a state, we must provide support and dignity through a living wage for workers who care for individuals with intense needs.

Oppose the Reduction of Special Education Services

NYSUT strongly opposes the executive budget proposal to allow school districts, BOCES and private schools the ability to petition the State Education Department for “flexibility” in complying with certain special education requirements.

This proposal would erode the quality of education for these students and diminish the protections these critical resources provide in educating our students with disabilities.

We should not ignore the individual needs of students with disabilities and we should support and expand general education services and programs for students who have learning difficulties. Students with different abilities require a team approach and one that needs to be carefully monitored throughout their education. We should protect our most vulnerable students and ensure they receive the best possible education without watering down standards.

Boards of Cooperative Educational Services (BOCES)

BOCES serves approximately 100,000 students in over 600 buildings that BOCES leases, owns or rents. Over 35,600 students developed college-and-career ready skills through career and technical education (CTE) programs taught in BOCES.

NYSUT is appreciative of both executive budget proposals that allow BOCES to apply for grants for the Advanced Courses Access Program and Pathways in Technology Early College High School (P-TECH) and we urge you to enact them.

NYSUT urges the Legislature to address BOCES capital needs. While NYSUT is supportive of the executive proposal that authorizes BOCES to establish recovery high schools and regional science, technology, engineering and mathematics (STEM) magnet schools for grades nine through 12, the state must address critical capital upgrades and improvements for BOCES buildings. We want to thank the Legislature for repeatedly supporting an amendment to the property tax cap to exempt BOCES capital projects, much like school districts’ capital projects are currently exempt. Unfortunately, this legislation has not been enacted. The need is critical. Either this issue should be addressed in an amendment to the tax cap or the state should provide a dedicated BOCES capital funding mechanism.

Career and Technical Education

Another important issue for NYSUT is Career and Technical Education (CTE). In 2015, the New York State Board of Regents approved multiple pathways to high school graduation and made changes to the diploma requirements. These pathways provide work-based learning opportunities and allows students to take an approved, rigorous examination that tests their knowledge of technical skills to fulfill part of the Regents examination graduation requirement. The New York State Board of Regents has emphasized that funding support is essential for building multiple pathways to high school graduation for students.

NYSUT urges you to include, in this year’s enacted budget, legislation that provides resources to support and expand access to CTE programs in BOCES, component districts and the Big 5 School Districts.

Additionally, the current aid formula for BOCES CTE programs has not increased since 1990. The state only provides aid for the first $30,000 of a BOCES instructor’s salary. The state should update the BOCES aid formula by increasing the aidable salary to the state average salary for teachers.

Similarly, Special Services Aid provides state support for CTE programs in the Big 5 School Districts. This funding formula pre-dates the Foundation Aid formula and should be updated to use the Foundation Aid per-student formula to calculate the aidable amount per student.

Additionally, Special Services Aid is currently limited to grades 10-12 in the Big 5 School Districts. We support ninth grade being included, to align these types of programs with the Regents’ adoption for multiple pathways to graduation.

Both of these state funding gaps negatively impact CTE programs and shift the costs of these vital programs to local school districts. New York should invest sufficient funding in order to respond to the economy’s increasing demand for diverse and technically prepared workers.

Expansion of Pre-Kindergarten and Full-Day Kindergarten

Empirical data shows that early education programs, like pre-kindergarten and kindergarten, play a major role in reducing the education achievement gap and lead to better outcomes in the academic and social development of children.

NYSUT is supportive of the executive budget proposal to expand pre-kindergarten and kindergarten. All school districts should offer pre-kindergarten and kindergarten programs as part of their regular school program.

Some school districts do not have pre-kindergarten and full-day kindergarten due to the current fiscal challenges they are facing. The allocation of new funding for pre-kindergarten, and the continuation of funding to incentivize kindergarten, could provide those districts with the additional financial support needed to establish pre-kindergarten and full-day kindergarten in their districts.

Mental Health Services for Middle Schools and Junior High Schools

NYSUT is supportive of the executive budget proposal that provides $1.5 million to create enhanced mental health support grants for wrap-around health services, improve school climate, combat violence and bullying and support social-emotional learning in middle schools and junior high schools.

Student Welcome Grants

NYSUT supports the executive budget proposal of $1.5 million for a refugee and immigrant student welcome program, $500,000 of which will be made available to school districts in Nassau and Suffolk counties for expanded community schools, providing school supplies for incoming students, training for staff, counseling and family engagement.

State Revenue

On the issue of enhancing state revenue, NYSUT supports the executive budget proposals, with amendments. Specifically, we call upon the Legislature to enact the enhanced millionaires’ tax that the Assembly has proposed in recent years. We thank the Assembly for carrying this proposal as it would benefit our students. We urge the Legislature to pass this progressive tax plan for the state’s highest earners, who make more than $5 million a year, which would raise several billion dollars annually in new revenue to support public education, health care and infrastructure improvements.

This common sense proposal should be enacted to ensure that our schools, colleges and health care institutions have the resources they need to properly educate students and treat those seeking care.

The Fiscal Policy Institute reports that contrary to the insistence by some, that progressive taxation will drive away the wealthiest taxpayers, however, this is not the case. Recent research on “millionaire taxes” by Stanford University, illustrates that the rich are generally so tied to local economic and social networks that they have largely not moved out of those states that have imposed higher income taxes.

Since the enactment of changes to the state’s income tax structure in 2009, the number of high-earners in New York has climbed and their incomes have grown much faster than that of the state’s working- and middle-class. The total income on high-earner returns grew by 45 percent – more than three times faster than all other New York tax returns.

Additionally, NYSUT fully supports closing the “carried interest” loophole, which allows partners at private equity firms and hedge funds to pay a greatly reduced federal tax rate on much of their income, by declaring it to be capital gains. This income, however, is regular income, and should be taxed as such. Private equity firms and hedge fund partners should be taxed at the same rate as teachers, nurses and every other worker, by raising state income taxes on private equity and hedge fund partners who live in New York. Closing the Carried Interest loophole will make the taxes they pay equal to the tax savings they receive from using the loophole at the federal level. We urge you to enact these proposals.

Conclusion

In conclusion, I would like to reiterate the fact that investing in our students, their futures and New York’s public schools, is a commitment to the future of this great state. NYSUT looks forward to partnering with the Legislature to ensure our students receive the necessary resources and programs for a high-quality, 21st century education that prepares them for college and career.

Again, thank you for the opportunity to testify before you today. I will now turn it over to Michael Mulgrew, President of the United Federation of Teachers.

46503

CB/JP/JL/AB

2-5-19