Testimony of Andrew Pallotta, President, New York State United Teachers, to the Senate Finance Committee, Liz Krueger, Chair, and Assembly Ways and Means Committee, Helene E. Weinstein, Chair, on the Proposed 2020-21 Executive Budget for Elementary and Secondary Education. February 11, 2020.

Chairperson Krueger, Chairperson Weinstein, honorable members of the Legislature and distinguished staff, I am Andrew Pallotta, President of New York State United Teachers (NYSUT). NYSUT represents more than 600,000 teachers, school-related professionals, academic and professional faculty in higher education, professionals in education, in health care and retirees statewide.

Thank you for the opportunity to testify today on the proposed 2020-21 New York State Executive Budget for Elementary and Secondary Education. I am joined by Michael Mulgrew, President of the United Federation of Teachers.

I come before you today, with a renewed and invigorated vision for improving public education and opportunities for children in our state. Over the past few months, I have witnessed children advocating for their educators and their future. I have traveled throughout the state, in a bus, to see and hear first-hand how NYSUT members — our educators — are doing their best with the resources they are provided, to ensure every child succeeds. This is why our members dedicate their lives to this profession — to provide our students with every possible resource for a successful future.

Only a few weeks ago, the State Education Department released a report declaring that the graduation rate for students statewide had increased to 83.4 percent. This increase in the statewide graduation rate, while headed in the right direction, is only an average and does not speak to those districts grappling with low graduation rates. While a number of school districts around the state are improving, others are not faring as well. Inequalities created by a lack of state funding severely impact these districts’ abilities to implement measures to address the root causes of low graduation rates.

At a time when we see continuing educational inequality in schools across New York, full-funding is especially critical for making further progress toward closing the achievement gap. If you join me, in fully funding education, from pre-K to higher education, it will go a long way to address the negative impact of the inequality created by this lack of funding.

School Aid

The 2020-21 New York State Executive Budget allocates $28.55 billion in funding for education. According to the school aid runs, this equates to an increase of two percent ($504 million in Foundation Aid).

However, the governor cites an increase of $826 million, or approximately three percent over the amount allocated in the 2019-20 New York State Enacted Budget. The one percent difference is attributable to the addition of the $576 million in school aid plus $250 million for the following: $200 million in unallocated funding; and $50 million in other programs (e.g., after-school programs, expansion of pre-K, early college high schools and other educational initiatives).

Both of these numbers are well below the $1.1 billion, or four percent, presented in the executive’s financial plan. Not surprising to anyone who has heard me speak before or has participated in one of our Fund Our Future bus tours knows, additional school aid will be needed in the enacted budget given that the tax cap is set at 1.81 percent for 2020-21, and schools are still owed more than $3.4 billion in Foundation Aid.

Both the Board of Regents and the Educational Conference Board (ECB) have called for additional funding for public education.

A total increase of $1.6 billion ($1.5 billion in Foundation Aid and $100 million to fully fund expense-based aids) is needed to begin a three-year phase in of Foundation Aid and to fund existing commitments to expense-based aids.

NYSUT, educational stakeholders and communities agree, fully funding Foundation Aid is the best vehicle to address the needs of all public school students.

State support for schools, as I previously mentioned, is critical, as the tax cap is set at 1.81 percent. The tax cap will continue to impede local school districts’ ability to raise revenue while school districts grapple with greater, more intense student needs and increased mandatory costs. Moreover, when you consider that on average only 37 percent of a school district’s funding comes from formula state aid, this places an even greater importance on state school aid, as it is an integral source of revenue for many school districts.

NYSUT urges the Legislature to provide $1.5 billion to fully fund Foundation Aid and, as the Educational Conference Board has recommended, provide an additional $500 million in targeted funding to: provide mental health services for students and improve school climate; provide continued support for struggling schools; increase the funding to meet the needs of English language learners (ELLs); offer high-quality professional development; and expand access for college and career pathways.

Foundation Aid Formula

During the previous few months, at the Senate roundtables to discuss the Foundation Aid formula, some of you had the opportunity to hear from urban, suburban and rural districts that educate students of every background, of every level of English proficiency, of every ability, from the wealthy to the most in need. All have agreed — the Foundation Aid formula must be fully-funded in order to provide all students with the resources they need.

Let us first start with the Foundation Aid formula itself. The 2007 Foundation Aid formula was a significant public policy achievement. The premise of the formula — ensuring that each district has the resources to provide students with an education that prepares them for the future — should remain the underpinning of school aid policy in our state. In addition, the formula, as enacted into law, would have provided significant additional state resources to districts that have been historically underfunded and guaranteed a minimum annual increase in aid for all districts.

Due to a lack of funding, Foundation Aid as we know it today does not currently support or respond to the needs of students, teachers or school districts. If properly funded, Foundation Aid would ensure that all students, regardless of where they live, attend a school that has sufficient resources to provide a quality education. However, Foundation Aid has never been close to fully funded.

Let me give you this example. After the 2016-17 school year, districts were owed $3.8 billion in Foundation Aid. After the 2019-20 school year, school districts were owed $3.4 billion. At the current rate, using past performance, it will take 25 years — an entire generation — to fully fund the Foundation Aid formula.

The formula is designed to reflect the number and needs of students, including children in poverty, students with disabilities and ELLs, as well as a regional cost adjustment, to reflect the range of cost-of-living levels across the state. Unfortunately, only half of the phase-in was implemented before the Great Recession occurred. At that point, the state implemented the Gap Elimination Adjustment (GEA) to help the state fill its budget shortfall. The GEA was eliminated in the 2016-17 New York State Enacted Budget.

Since 2012, there have been only modest annual Foundation Aid increases. Of that amount, over two-thirds of this aid is owed to high-need districts ($2.3 billion).

Unpaid Foundation Aid 2019-2020

|

District Need Category

|

Amount Owed

|

Percent of Total

|

|

High Need

|

$2,325,802,174

|

68.1%

|

|

Average Need

|

$801,565,245

|

23.5%

|

|

Low Need

|

$287,209,530

|

8.4%

|

|

Total

|

$3,414,576,949

|

100.0%

|

Unless Foundation Aid is fully funded, it will not be responsive to student and community needs. New York State public schools have experienced significant changes in student composition over the past decade.

Statewide Change in Student Groups 2007-08 to 2017-2018

|

Category

|

Change in Enrollment

|

Percent Change

|

|

Students with Disabilities

|

+72,287

|

+17%

|

|

Students in Poverty

|

+175,684

|

+15%

|

|

English Language Learners

|

+36,354

|

+18%

|

While overall enrollment in New York State’s public schools has declined, the chart above highlights the double digit increases these schools have seen in the number of children with disabilities, students living in poverty and ELLs. These students present a wide range of needs that require additional educational programming and services. Special education students and ELLs are entitled, by law and regulation, to a variety of services that address specific issues they may face in the academic environment.

The Foundation Aid formula reflects those costs in the form of pupil weightings. However, as these types of students have increased, it has not driven additional aid to impacted school districts. The failure to fully fund Foundation Aid means that when additional students with needs enroll in a school district it generates additional Foundation Aid on paper. However, that does not translate into additional state aid to the school district.

Furthermore, the small increases in Foundation Aid that have been allocated in recent years have not been made according to district needs. For example, in certain years, all small cities have had the same phase-in factor, irrespective of need, and each of the Big 5 city school districts have their own phase-in factor that was not generated by neutral factors, such as student needs and community wealth levels.

We would strongly urge against modifications to the formula unless proper funding is secured. We have shared some ideas at the Senate hearing on December 3, 2019, however, while a debate regarding what the proper weighting should be for ELLs is appropriate, it does potentially sidetrack us from the need to fully fund the formula. Otherwise, unless schools are fully funded, we are simply increasing or decreasing the amount of aid still owed to various districts and no more aid would flow to those districts to provide proper programming for school children.

NYSUT believes that this should be accomplished by reestablishing a phase-in schedule for the Foundation Aid formula. This phase-in schedule was repealed several years ago and needs to be re-established in law. We, along with the entire Educational Conference Board, recommend a three-year time-frame to fully fund the formula.

As you have already heard from NYSUT and other educational stakeholders, community groups, school boards and superintendents around the state, we all believe that fully funding the Foundation Aid is the best vehicle to address the needs of all public school students.

School Spending Reporting and Funding Equity

We urge you to reject the executive budget proposal that would require school districts to submit a remedy plan for a school that the director of the budget has deemed to be underfunded, or risk losing their Foundation Aid increase. NYSUT advocates for funding to be given to these schools through the full funding of Foundation Aid, not by shifting costs within districts so that students in many districts are pitted against each other for limited resources.

NYSUT urges you to reject this proposal and keep control in the hands of the local community.

Expense-Based Aids, Boards of Cooperative Educational Services (BOCES) and Special Services Aids

The 2020-21 New York State Executive Budget proposal merges 10 expense-based aids (BOCES, special services, high tax, charter school transitional, textbook, school library materials, computer software, computer hardware and technology, supplemental public excess cost and academic enhancement) into Foundation Aid.

The proposed collapsing of these 10 expense-based aids into Foundation Aid would negatively impact the resources that school districts, including the Big 5 (NYC, Yonkers, Syracuse, Buffalo and Rochester) could provide to students and severely damage and curtail BOCES programs and services statewide. This change could also impact administrative and management services and professional development in school districts.

The executive budget proposal essentially eliminates BOCES Aid and Special Services Aid in future years. This proposal invalidates the current formulas while appearing to increase Foundation Aid. Since 2016-17, BOCES aid has increased by $146 million and Special Services Aid has increased by $12 million.

This is problematic since in future years, as school districts purchase more BOCES services and programs and additional students enroll in Career and Technical Education (CTE) programs in the Big 5 and non-component districts, they will not qualify for any additional state aid.

Without this aid, school districts already constrained by the property tax cap would have to drastically change the educational services they offer. The elimination of these aids would seriously erode CTE programs in our state, especially in rural areas where there is often a lack of CTE capacity.

BOCES and the Big 5 school districts offer hundreds of successful CTE programs that students can choose from. These programs are created in conjunction with various businesses and prepare students for a career in emerging and established industries such the technology sector, the green economy, the audio/visual field, communications, architecture, automotive and aviation repair, finance, science, technology, engineering and construction just to name a few.

The state should provide additional funding to school districts so they may expand and support the delivery of BOCES and Special Services Aids, continue to improve graduation rates and prepare our students to enter the workforce.

NYSUT calls for an increase in the current aid formula for BOCES CTE programs which has not been increased in 30 years. The state only provides aid for the first $30,000 of a BOCES instructor’s salary and it should be increased to reflect the current factors. Last year, the enacted state budget included increases in BOCES district superintendent’s salary cap, which had not been adjusted in 15 years. Raising this would provide parity for our CTE BOCES educators through a higher reimbursement rate.

In addition, NYSUT believes that an update to Special Services Aid is required. Currently, per pupil Special Services Aid formula only provides: approximately $3,200 in our upstate city districts, approximately $2,000 per pupil aid in Yonkers and only $1,500 per pupil aid in New York City. Ninth grade students should also be captured in the Special Services Aid since they are presently excluded.

I urge you to reject the executive budget proposal to merge and subsequently eliminate these 10 expense-based aids into Foundation Aid.

Career and Technical Education

When the New York State Board of Regents approved multiple pathways to high school graduation and made changes to diploma requirements in 2015, they emphasized that funding support was essential for creating the success of CTE programs.

This outdated support and chronic underfunding by the state limits the creation and expansion of CTE programs in our state while shifting the costs of these vital programs to local school districts, which are already underfunded and constrained by the tax cap. Just last year, 96 percent of high school seniors enrolled in CTE programs graduated; let us continue these successful programs with proper funding. We urge the Legislature to update funding to CTE programs to ensure our students continue to have rigorous and relevant programs.

NYSUT urges the Legislature to include this funding in this year’s enacted budget to support and expand access to CTE programs in BOCES and the Big 5 school districts.

Monitors

NYSUT would like to thank the Legislature and the governor for passing and enacting legislation to place an academic monitor in the Hempstead School District and a fiscal monitor in both the Hempstead and Wyandanch school districts. NYSUT believes these monitors will help to ensure that the students in these districts get the education they deserve while ensuring the proper and responsible use of funds by the districts.

NYSUT urges the governor and Legislature to again ensure fiscal integrity and educational excellence in the Rochester City schools by enacting provisions to provide an educational and fiscal monitor appointed solely by the state education commissioner, paid for by the state, to oversee the turnaround of that district to ensure that the students of the Rochester City School District are given every chance to succeed.

Community Schools and Receivership

The executive budget proposes the addition of $50 million in new set-aside funding, for a total of $300 million to community school programs and continues the minimum amount of the district Foundation Aid set-aside of $100,000. In addition, the executive budget raises the number of eligible schools to 440 schools in the state and includes Comprehensive Support and Improvement (CSI) schools. Currently, there are 245 CSI schools. NYSUT supports ensuring these schools receive the necessary resources and tools needed to improve student achievement.

Community schools foster partnerships between the school and other community resources. They focus on academics and services that assist in developing student learning and close the achievement gap, build stronger families and create healthier communities.

NYSUT urges the Legislature to maintain the $250 million in existing community school set-aside Foundation Aid funding and provide new funding of $100 million in Categorical Aid. By providing future funding in Categorical Aid, the Legislature can better track the results of this investment and help ensure stable and consistent funding to these schools. Under the executive budget’s school aid proposal, New York City alone will receive $139 million for the community school set-aside. Educational stakeholders like the Legislature, NYSUT and the UFT have no sense as to how that funding would be allocated in their respective school districts. In New York City alone, that is a full 62 percent of the current proposed Foundation Aid increase.

We also urge passage of S.5602 (Mayer)/A.8010 (Benedetto), which would create model policy to convert schools in receivership to community schools and provide a stable structure that encourages highly qualified educators to work in these schools. There is no evidence to support the argument that firing educators who teach in struggling schools raises student achievement. In fact, the current law encourages them to leave as soon as possible — so they can go teach in other schools.

As the chart below shows, there are 43 receivership schools in 11 school districts.

|

District

|

Number of Receivership Schools

|

Amount of Foundation Aid Owed

|

|

ALBANY

|

2

|

$31 million

|

|

BINGHAMTON

|

1

|

$15 million

|

|

POUGHKEEPSIE

|

1

|

$7 million

|

|

BUFFALO

|

3

|

$100 million

|

|

ROCHESTER

|

14

|

$86 million

|

|

HEMPSTEAD

|

2

|

$78 million

|

|

NEW YORK CITY

|

12

|

$1.1 billion

|

|

SYRACUSE

|

5

|

$48 million

|

|

TROY

|

1

|

$12 million

|

|

SCHENECTADY

|

1

|

$36 million

|

|

YONKERS

|

1

|

$52 million

|

|

TOTAL

|

43

|

$1.5 billion

|

Schools in receivership have suffered from years of chronic underfunding and these school districts are now owed over $1.5 billion in Foundation Aid. Due to years of inadequate funding, school districts with persistently struggling schools have had to make difficult financial decisions regarding staffing, programs and services. These decisions often have a negative impact on both the schools’ and students’ academic performance.

NYSUT urges the Legislature to allocate $75 million exclusively for schools that are in receivership to support their school turn-around efforts, as it did in the 2015-16 New York State Enacted Budget.

Tax Cap

A perennial favorite of our time together each budget season is the tax cap. As I have already mentioned, the 1.81 percent tax levy limit for 2020-21 will have serious negative effects on our students and their schools. This year, statewide, school districts will only generate approximately $400 million locally to fund their programing. Eliminating or amending the tax cap continues to be a priority for NYSUT.

NYSUT urges the Legislature to amend the tax cap so that school districts and localities have the ability to raise their tax levy by two percent or CPI, whichever is greater. PILOTs should be factored into tax cap calculations, and other changes should be made to ease the burden on school districts and local tax payers. NYSUT has a host of other amendments that could be made to ease the burden of the tax cap on school districts and I would be happy to share them with you at another time.

Living under a tax cap has hindered most districts’ ability to restore recessionary cuts to classroom services. Without significant additional state aid, and a reasonable adjustment to the tax cap for costs beyond their control, many school districts will lack sufficient resources to fund current programs. The tax cap hurts our poorest districts the most by placing severe limits on their ability to raise funds.

While the purpose of the tax cap is to generate savings for property owners and businesses, it has had the negative consequence of exacerbating educational inequities and defunding public education.

NYSUT agrees that property taxes are high in our state but studies show the best way to address this issue and to adequately fund public education is through a “circuit breaker” program. A circuit breaker program would provide targeted relief based on one’s ability to pay. NYSUT believes the state should implement a circuit breaker to replace the tax cap. This, in our view, is a more progressive way of lowering property taxes in this state.

Take a Look at Teaching

NYSUT is continuing its “Take a Look at Teaching” initiative spearheaded by our Executive Vice President, Jolene DiBrango. This initiative seeks to address the teacher shortage, teacher diversity challenges facing our state and highlight the benefits of a rewarding career in education.

Take a Look at Teaching is a union-led initiative to increase the number of students and career changers entering the teaching profession. It also focuses on increasing diversity in the education workforce and elevating the teaching profession as a whole.

NYSUT has conducted a series of Take a Look at Teaching summits in Syracuse, Rochester, Riverhead, Potsdam, and Yonkers, among others. These summits focus on bringing the community to the table, speaking with students about their needs and experiences and changing the narrative about teaching.

Between 2009 and 2017, enrollment in New York teacher education programs fell 53 percent. This mirrors the national trend. The New York State Teacher Retirement System projects that one-third of New York’s teachers could return in the next five years. New York State will need 180,000 teachers in the next decade.

As we seek to recruit new teachers and address the impending shortage, NYSUT urges the Legislature to increase funding to the Mentor Teacher Intern Program (MTIP) the MTIP supports new educators by easing the transition from teacher preparation to practice.

NYSUT recognizes the need to diversify the teaching profession, while also preparing educators of tomorrow in identified subject and regional shortage areas. To that end, we are asking the Legislature to provide $10 million in funding for the Teacher Loan Forgiveness program and to include higher education faculty.

NYSUT also urges the Legislature to expand the funding available for the Teacher Opportunity Corp (TOC) to $10 million. The TOC provides grants to public and private colleges in New York State to help recruit and diversify the ranks of the teaching profession while supporting students pursuing a career in education.

Charter Management Operators

I would now like to turn to the issue of charter management operators. Currently, school districts are being penalized and damaged by the state’s process for charter school tuition reimbursement.

Our traditional public schools should not be held responsible for state-mandated increases in charter school tuition payments. Low-wealth, high-needs districts are hit especially hard by the current lagged system. These schools are already struggling financially. Therefore, NYSUT calls for a charter tuition formula fix. In the recent past, the state has fully reimbursed school districts for the per pupil increase in tuition for charter schools – that is no longer the case. NYSUT urges the state to maintain its past practice and fully fund the increased per-pupil tuition costs that public school districts must pay to charter schools, so that public school districts are not subsidizing charter schools in their districts. Very few charter operators collaborate with their local school district on how to best meet students’ needs or what best practices are working in their schools.

In addition, the property tax cap law exacerbates the inequalities between public schools and charter schools. Unlike public schools, charter schools can increase their budgets without any public approval. Moreover, they do not elect independent school board members via a public vote. Under the law, the charter school budgets have the unfettered ability to grow at the expense of public schools, which are constrained by the property tax cap. It is unfair to taxpayers that the current charter school law does not require public transparency with regard to the charter management operators that support these schools.

In 2018-19, six percent, or 149,000 students in New York State attended charter schools, 80 percent or 119,200 students were enrolled in the City of New York.

This year, the executive has proposed a 3 percent increase for school aid. In the same proposal, the executive proposes a total increase of 14 percent for the charter industry. New York City and the 15 school districts that have the most students enrolled in charters are seeing their tuition costs rise $206 million, or almost half of the Foundation Aid increase proposed by the executive; of the $206 million, $178 million of the increase is in New York City alone.

To explore how increases in charter industry growth are siphoning money from public education, we will look at school districts from throughout the state that have more than 5 percent of their students enrolled in charters. Those school districts are: Albany, Buffalo, Cheektowaga, Elmira, Green Island, Hempstead, Lackawanna, Lansingburgh, Mount Vernon, Riverhead, Rochester, Roosevelt, Syracuse, Troy, Utica and the City of New York.

Between 2014-15 and 2019-20, these sixteen districts experienced a $1.1 billion, or 73 percent, increase in their payments to charter schools.

During this five year period, New York City’s payments to schools increased by $1 billion or an increase of 77 percent. In the past two years alone, New York City charter school tuition has increased by over 11 percent. These figures do not include rental payments.

When we include all sixteen school districts, the results are even more stunning. In total, Foundation Aid increased by $1.96 billion in these sixteen districts. Total charter school tuition payments increased by $1.13 billion during that period. Over the past five years, more than half of the increase in Foundation Aid has been used to offset the increase in charter school tuition payments to these districts. When we fight alongside you to increase funding for public education in your districts, a majority of it is absorbed by the charter school industry.

In addition, the debilitating effect of the charter industries proliferation on some school districts such as Albany, Buffalo, New York City and other local school districts is clear. Charter school reform must include a remedy to address co-location and over-saturation of new charters.

Furthermore, based on the most recent data, the charter industry’s estimated cash reserves of approximately $400 million demonstrates why the charter industry must be held to more stringent standards of accountability and transparency.

The executive budget also proposes language to circumvent the cap on new charter schools in New York City by proposing that a reissuance of a surrendered, revoked or terminated charter would not count against the cap. These charters were issued and then were subsequently terminated, revoked or surrendered because of low academic performance and/or the school surrendered its charter and closed. Charter schools are experiments and these were failed experiments. NYSUT urges the governor and Legislature to not contemplate expanding the charter industry until meaningful reforms are enacted to provide equity in the communities they serve and transparency and accountability to the taxpayers that pay for them.

Charter operators, both upstate and in New York City, significantly under-enroll students who are at-risk of academic failure. For example, the Buffalo public school district educates more than three times as many English Language Learners and almost twice as many students with disabilities. In Rochester, charter schools enroll 9 percent of students with disabilities while the public school district enrolls almost twice as many students with disabilities. These are just two examples of a systematic problem within the charter industry and the under-enrollment issues that must be addressed to ensure students are fairly served compared to their neighborhood public schools.

In addition, the enrollment practices charter management operators use serves their best interest. Enrollment is by lottery and operators can discharge students at any time. Public schools enroll and accept all students, regardless of their abilities. The law should be amended to require the charter industry to educate a comparable number of ELL students, students with disabilities, students living in poverty and students in temporary housing, non-renewal of a charter should be considered if they are not in compliance. The time is long overdue for the state to hold charter operators accountable.

NYSUT urges the Legislature to enact a number of reforms that bring the charter industry to a closer standard to traditional schools. These reforms include but are not limited to the following: S.4237 (Hoylman)/A.8030 (Benedetto), which requires transparency and accountability of charter schools; S.6043 (Liu)/A.8027 (Benedetto), which repeals charter school facilities aid; S.2743 (Addabbo)/A.6934 (Nolan), which requires charter schools to disclose financial information on contracts signed with Education Management Organizations (EMOs) to any authority that can audit charter schools; S.5978 (Mayer)/A.8028 (Benedetto), which includes school districts and community school districts in the charter approval process in over-enrolled districts; S.3334-A (Jackson)/A.3289-A (Bichotte), which requires charter school discipline codes to mirror local school district discipline codes; and A.4124 (Pretlow), which provides transparency and accountability of charter schools and provides fiscal relief to the school districts where charter schools are located.

Nonpublic Schools

The executive budget provides nonpublic schools with over a 3 percent increase above last year’s allocation. More specifically, the executive budget increases a reimbursement program for Science, Technology, Engineering and Math (STEM) instruction by $5 million for a total of $35 million. NYSUT urges the Legislature to reject this continued funding stream that assists in paying for teaching staff in nonpublic schools as this blurs the line between state funding of sectarian education and the New York State Constitution.

Promoting Positive Discipline In Schools

NYSUT believes current disciplinary approaches that focus exclusively on punishment fail to help students identify and address the causes of their behavior. These punitive approaches do not help to close the loop with educators or understand the causes of misbehavior. Programs for social-emotional learning help to foster characteristics that contribute to student success in education and future employment. In addition, programs that focus on addressing the whole child, rather than just their behavior can decrease student suspensions, expulsions, push-outs, referrals to alternative institutions, and arrests in our public schools, all of which can increase and exacerbates the incarceration of our youth.

UFT will discuss their Positive Learning Collaborative program, which incorporate social and emotional learning practices — with educators and all school staff as stakeholders resulting in a positive and supportive school culture.

NYSUT works to ensure that schools have the necessary resources, curricula and professional learning opportunities to emphasize social-emotional learning, by helping students to: recognize and manage their emotions; develop caring and concerns for others; establish positive relationships; make responsible decisions; foster positive conflict-resolution strategies; build self-confidence; realize self-actualization; and use their personal growth to achieve greater academic success.

The executive budget proposal includes $3 million for alternative discipline grants to high-need districts or districts identified as having a high number of student suspensions or exclusions. We ask the state increase this funding in order to make resources available to every school district in New York State rather than a competitive grant. NYSUT believes that funding is an integral part of any successful restorative practice initiative to improve and create a positive school environment for every student.

Lastly, we urge the Legislature to include charter schools in any provisions that impose alternative approaches in schools as data has shown they suspend and expel students statewide at alarmingly high rates.

Power Plants, Tax Certiorari and Final Cost Reports

Another very important issue for NYSUT is the growing number of school districts that have been or will be affected by power plant closures. We urge the Legislature to continue to provide funding in this year’s enacted budget to ensure that school districts are fully reimbursed by the state when districts are affected by the closure of power plants, like Indian Point, or where the full valuation of a tax base has been reduced, such as in North Rockland. The Legislature has appropriated funds for school districts already facing these issues, such as Kenmore Tonawanda in Western New York, and we thank you and ask for your continued commitment to these affected districts.

NYSUT urges the Legislature to expand the funding program for those additional districts that will face either power plant closures as the state retools its electric generation capabilities or those that have or will face adverse tax certiorari decisions.

In addition, we urge the Legislature to address the issues and problems surrounding penalties related to a school district’s final cost report for capital projects. Specifically, we ask that school districts be held harmless for such ministerial errors.

The current system hurts students. If a district runs into problems with its final cost report it could be forced to slash programming and resources from students because of the harsh penalty in law.

Typically, low-wealth districts take on school building capital projects only because of the promise of state building aid. Without the state’s assistance, these districts would never be able to afford these projects on their own.

Furthermore, the current penalty of clawing-back state aid, stemming from either a mistake in, or a late submission of, a district’s final cost report has a much greater impact on low-wealth, under-resourced school districts. These districts are not equipped to absorb the impact these penalties have on programming and resources for students. For a low-wealth district, facing the loss of state building aid is potentially catastrophic as they would not be able to levy the taxes required to absorb the fiscal hit to their budget.

NYSUT wants to recognize and thank the Legislature and the governor for assisting the Newburgh, Chester, Mount Morris, Roscoe and Spackenkill school districts, by forgiving certain penalties due to ministerial errors.

Currently, there are several school districts, throughout the state that have been identified as having their state aid subjected to recovery for problems associated with their final cost reports. The school districts are: Panama (Chautauqua County); Fulton (Fulton County); Corning (Steuben County); Cold Spring Harbor (Suffolk County); Huntington (Suffolk County); Islip (Suffolk County); Liverpool (Onondaga County); Mahopac (Putnam County); and Monitcello (Sullivan County).

Each legislative session, the Legislature finds that it must deal with a number of bills that normalize and validate final cost reports in order to save districts from losing their state aid, thereby protecting student academic programs and services.

Surely there is a better, more efficient way to oversee building aid projects by school districts without sacrificing the health and safety of those who work and learn in our schools, while still maintaining strict fiscal controls.

NYSUT urges the elimination of any fiscal penalty to a school district stemming from ministerial errors associated with final cost reports.

Teacher Centers and National Board Certification

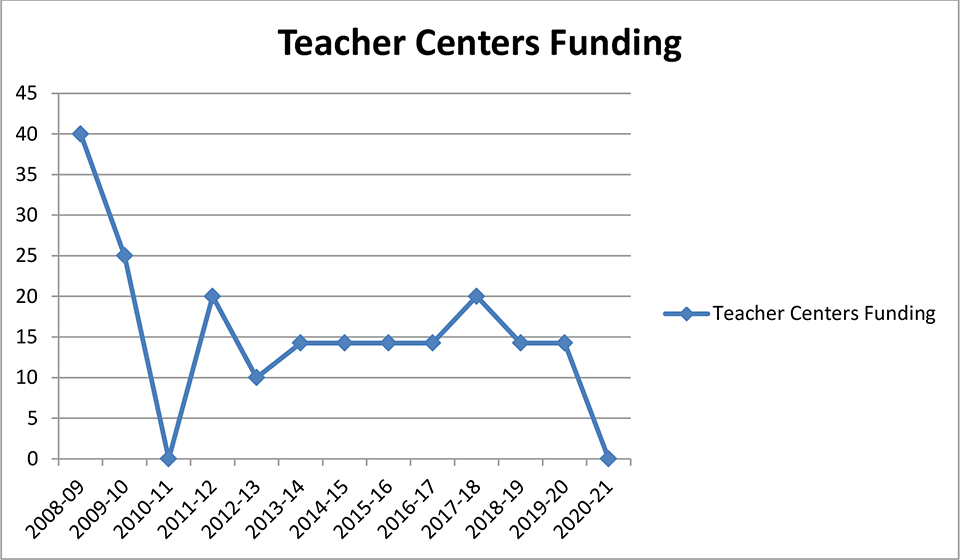

The executive budget completely eliminates funding ($14.26 million) for Teacher Centers. Teacher Centers were established by the Legislature to provide comprehensive, ongoing professional development and support services to our teachers. They are the only state-funded vehicle guaranteed to support teacher professional development in all school districts, including over 200 high-need schools/districts, BOCES, non-public and charter schools.

These centers support programs that ensure educators are exposed to emerging techniques, practices and technologies that use data to inform and improve instruction to be increasingly effective in the classroom and help close the achievement gap. They also conduct courses and programs that enable new teachers to satisfy certain professional requirements.

We urge you to restore funding for Teacher Centers to 2008-09 levels of $40 million so we can continue to improve student achievement and make every teacher highly qualified in each classroom throughout the state.

The executive budget funds National Board Certification at $368,000. We urge you to support teachers’ opportunity for self-directed professional growth by increasing funding for the New York State Albert Shanker Grant for National Board Certification to $1 million. National Board Certified Teachers across New York State provide ongoing benefits to their students, schools and communities. Research shows that promoting excellence in teaching directly benefits students in the classroom by helping them thrive in school and in life.

4201, 4410, 853 and Special Act Schools

NYSUT continues to strongly support the missions of 4201, 4410, 853 and Special Act schools. We call on the state to work towards achieving educational funding parity with our school districts. Specifically, we urge the Legislature to provide regular, predictable increases in their tuition rates. NYSUT is also appreciative of the $30 million capital fund enacted in last year’s budget for 4201 schools that serve the deaf and blind. We would urge the Legislature to increase that amount and to create capital fund programs for 853 Schools, Special Act schools and 4410 Programs.

Specialized schools have no taxing authority, nor do they receive typical school aid increases that benefit public school districts and their students. Students attending these schools have specialized educational needs that cannot be served in another setting. We urge the Legislature to ensure that these schools receive adequate support so they may better plan and prepare for the future without the worry of financial insolvency. As you move into budget negotiations, we urge you to provide all of these schools with a funding percentage increase that is at least on par with that of our traditional public schools.

We also strongly support the provision contained within the executive budget to provide $17.2 million for increased salaries for staff in 4201, 4410, 853 and Special Act schools.

Syracuse - Science, Technology, Engineering, Arts and Mathematics (STEAM)

The executive budget provides up to $71.4 million for the development of the Syracuse Comprehensive Education and Workforce Training Center and a STEAM nine through 12 school for students residing in Central New York.

This initiative builds on legislation enacted earlier this year that provides expanded learning opportunities for students residing in Central New York, in the areas of science, technology, engineering, arts and mathematics (STEAM), in addition to core academic areas required for the issuance of a high school diploma. The Syracuse City School District Regional STEAM High School will be the first STEAM high school in the Central New York region.

NYSUT’s local, the Syracuse Teachers Association, has been an educational stakeholder involved in the planning of this initiative and we firmly believe this STEAM high school will prepare our students for jobs that are in demand now and in the future.

Direct Care Workers

NYSUT urges the Legislature to include a living wage for those who work directly with, and care for our students and children with disabilities in other not-for-profit agencies such as Abilities First in the Dutchess County, Aspire in Erie County and Oak Hill in the Capital region. We believe that as a state, we must provide support and dignity through a living wage for workers who care for individuals with intense needs.

Special Education Services

The executive budget again proposes to allow all school districts, BOCES and private schools to petition the State Education Department for flexibility in complying with certain special education requirements. This would allow districts to seek approval to cut services to obtain fiscal relief. We urge the Legislature to reject this proposal as it raises significant concerns regarding the potential erosion of services to students with disabilities.

Special Education Residential Placements

NYSUT urges the Legislature to oppose the executive budget proposal to shift the cost of special education residential placements from the Office of Children and Family Services (OCFS) to school districts.

Currently, OCFS is responsible for the “maintenance costs” of students who are placed in residential schools. These placements are made by a school district's Committee on Special Education. The executive budget would eliminate the 18.42 percent state share for placement by districts outside of New York City and increase the school district’s share from 38.4 percent to 56.85 percent. This proposal shifts state costs to local school districts, which are already underfunded and constrained by the tax cap.

Federal Action on School Vouchers

NYSUT urges the Legislature to continue its support for public education and create safeguards against intrusive federal action on school vouchers, such as the Education Freedom Scholarship championed by the Secretary of Education Betsy DeVos. This defunding of public education under the guise of school vouchers allows public funds to be used to support private and sectarian education and supports schools that selectively exclude students with disabilities, students with different learning abilities, students of color, students of different creeds and lesbian, gay, bisexual or trans students.

State Revenue

When it comes to fully funding public education, more is needed. Instead of fighting over the last slice of pie, New York needs a bigger pie. You might be thinking apple, pecan or even a chocolate cream pie, but being from the Brooklyn and teaching for 24 years in the Bronx, I am thinking pizza pie. Every year we hear the same thing at the start of the budget process: We have a significant deficit, so do not ask for more money. But what we are really asking for is for New York to keep its promises. Educational inequality is the most pressing issue of our time because the state is billions of dollars behind on Foundation Aid funding for roughly 400 school districts statewide.

The time has come for New York to fund our future. That means paying school districts what they are owed, investing in SUNY and CUNY two-year and four-year colleges, investing in SUNY hospitals and closing the TAP gap.

And let us be clear that there is not a lack of money in New York to do this. Billionaires and the ultramillionaires can afford to pay their fair share toward essential state services. It is time New York finally made them do just that.

How should New York State raise money to fund our future and provide for our children’s education and health, to provide vital services to citizens of our state? NYSUT believes that there are three common sense revenue enhancers that the Legislature and executive should pursue: adding three income tax brackets for ultramillionaires, a wealth tax on billionaires and a pied-à-terre tax.

NYSUT calls upon the Legislature to enact the enhanced millionaires’ tax that the Assembly has proposed in recent years. We thank the Assembly for carrying this proposal as it would benefit our students. We urge the Legislature to pass this progressive tax plan for the state’s highest earners, who make more than $5 million a year, which would raise several billion dollars annually in new revenue to support public education, health care and infrastructure improvements.

From 2009, when the millionaire’s tax was first enacted, to 2016, the number of millionaires in New York grew by 72 percent and their wealth increased by 54 percent. By comparison, the wealth of non-millionaires had only risen by 33 percent in that time.

The ultramillionaire’s tax, as proposed in the 2019 Assembly one-house budget, would create a higher income tax bracket for incomes above $5 million, $10 million and the top bracket of 10.32 percent for those with an income of over $100 million per year. The proposed top bracket would still be below the current tax rate in both New Jersey (10.75 percent) and California (13.3 percent). It is estimated that these new income tax brackets, which would affect 4 percent of our residents, would generate upwards of $2.2 billion.

As well, NYSUT calls on the Legislature to enact a wealth tax on billionaires that would create a yearly assessment on the speculative wealth of billionaires, looking at wealth in speculation, which includes unrealized capital gains. A wealth tax on billionaires is projected to generate $10 billion or more per year. The Fiscal Policy Institute estimates that 112 New Yorkers (0.000006 of the state’s residents), who cumulatively hold $500 billion in assets, would be subject to this wealth tax proposal.

The third revenue enhancer that NYSUT supports to help fund education, health care services for our state’s citizens is the pied-à-terre tax, which would add roughly $650 million per year to state coffers. This tax, as proposed in S.44 (Hoylman)/A.4540 (Glick), would be an assessment on luxury, non-primary residences in New York City with an assessed value of over $5 million. It is estimated that a mere 2 percent of the city’s housing stock would qualify for the pied-à-terre tax.

The Fiscal Policy Institute reports that contrary to the insistence by some, that progressive taxation will drive away the wealthiest taxpayers, this is not the case. Recent research on “millionaire taxes” by Stanford University, illustrates that the rich are generally so tied to local economic and social networks that they have largely not moved out of those states that have imposed higher income taxes.

These common sense proposals should be enacted to ensure that our schools, colleges and health care institutions have the resources they need to properly educate students and treat those seeking care.

Conclusion

In conclusion, I would like to reiterate the fact that investing in our students, their futures and New York’s public schools through fully funding the Foundation Aid formula, is a commitment to the future of this great state. NYSUT looks forward to partnering with the Legislature to ensure our students receive the necessary resources and programs for a high-quality, 21st century education that prepares them for college and career.

Recently, I was back in the Bronx on a Fund Our Future bus tour for a great visit with the educators of I.S. 181 Pablo Casals, including Christopher Warnock, the principal. Principal Warnock said: “We are trying to prepare our students for the jobs of today, but can only do so on a limited basis. But, how are we to prepare them for the jobs that have yet to be created with limited funding?” Fully funding the Foundation Aid formula is the answer.

Again, thank you for the opportunity to testify before you today. I will now turn it over to Michael Mulgrew, President of the United Federation of Teachers.

#47952

2/11/20

JL/JP/AB/ARR