Overview

As required by law, each year prior to the school budget vote all districts must submit a Property Tax Report Card to the New York State Education Department (SED). The data contained in the 2018 Property Tax Report Card compares the 2017-18 school budget with the 2017-18 proposed school budget and the 2016-17 tax levy with the 2018-19 projected tax levy. Voters will cast ballots on 2017-18 school budgets on May 15th.

In total, 669 school districts submitted their 2017 Property Tax Report Card. The Big Five City school districts are not covered by this requirement as the residents in these districts do not vote on their school budget.

In addition to the spending and tax levy increases, districts are also required to report three parts of the fund balance on the Property Tax Report Card: (1) the amount and percent of the unrestricted fund balance, (2) the restricted fund balance and (3) the appropriated fund balance. Although the unrestricted fund balance is limited by law to no more than 4 percent, 162 school districts reported that they estimate that they will have a fund balance over that legal limit for 2018-19. In addition, 311 school districts reported that they will be right at that 4 percent limit for 2018-19.

For the first time this year, districts were also subjected to a new reporting requirement. The Property Tax Report Cards must now include detailed information about Restricted Reserve Funds: the name of each reserve fund, a description of its purpose, the balance as of the close of the third quarter (3/31) of the current fiscal year and a brief statement explaining any plans for the use of each such reserve fund for the upcoming fiscal year.

School districts also reported information associated with the calculation of their property tax levy cap. Statewide, there are 13 school districts that are proposing a 2018-19 property tax levy that exceeds their maximum tax levy limit, meaning these districts must get at least 60 percent voter approval for their budget to be adopted.1

The compilation of this information is available on SED’s website at: http://www.p12.nysed.gov/mgtserv/propertytax/Copyof2018-19PTRC5_2_18_Post_R.xlsx

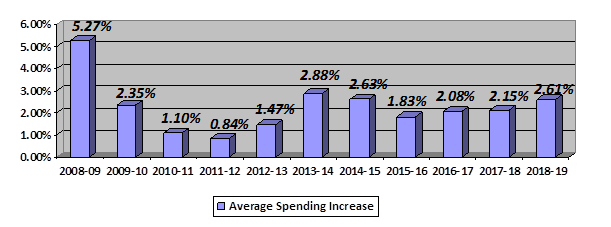

Spending

According to the data contained in the 669 Property Tax Report Cards, school districts on average are proposing budgets for 2018-19 that contain a spending increase of 2.61 percent. Last year the average statewide spending increase that districts presented in their 2017-18 school budgets was 2.15 percent. The following chart provides a recent history of the statewide average spending increases.

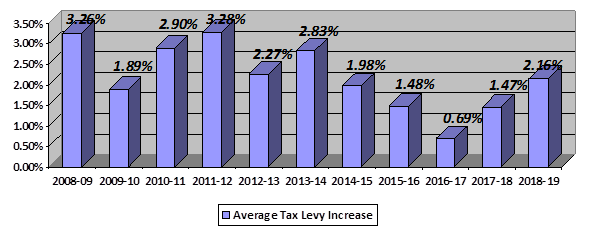

Taxes

The Property Tax Report Cards also reveal that the average tax levy increase contained in the proposed 2018-19 school budgets is 2.16 percent. Last year the average statewide tax levy increase was 1.47 percent. The following chart provides a recent history of the statewide average tax levy increases.

(1) The 13 districts are: Alfred-Almond, Cazenovia, Chateaugay, Chazy, Clymer, Eden, Evans-Brant, Greenport, Johnstown, Mamaroneck, New Rochelle, Stamford, and Westport.