As required by law, each year prior to the school budget vote all districts must submit a Property Tax Report Card

to the New York State Education Department (NYSED). The data contained in the 2020 Property Tax Report

Card compares the 2019-20 school budget with the 2020-21 proposed school budget and the 2019-20 tax levy

with the 2020-21 projected tax levy. This year all voting will be conducted by mail ballots and the ballots will

be counted on June 9tth.

In total, 653 school districts submitted their 2020 Property Tax Report Card and 19 school districts had not yet

submitted the required filing. The Big Five City school districts are not covered by this requirement as the residents in

these districts do not vote on their school budget.

In addition to the spending and tax levy increases, districts are also required to report three parts of the fund balance on

the Property Tax Report Card: (1) the amount and percent of the unrestricted fund balance, (2) the restricted fund

balance and (3) the appropriated fund balance. Although the unrestricted fund balance is limited by law to no more

than 4 percent, 200 school districts reported that they estimate that they will have a fund balance over that legal limit for

2020-21. In addition, 308 school districts reported that they will be right at that 4 percent limit for 2020-21.

This is the third year that districts are also required to submit detailed information about their Restricted Reserve Funds:

the name of each reserve fund, a description of its purpose, the balance as of the close of the third quarter (3/31) of the

current fiscal year and a brief statement explaining any plans for the use of each such reserve fund for the upcoming

fiscal year.

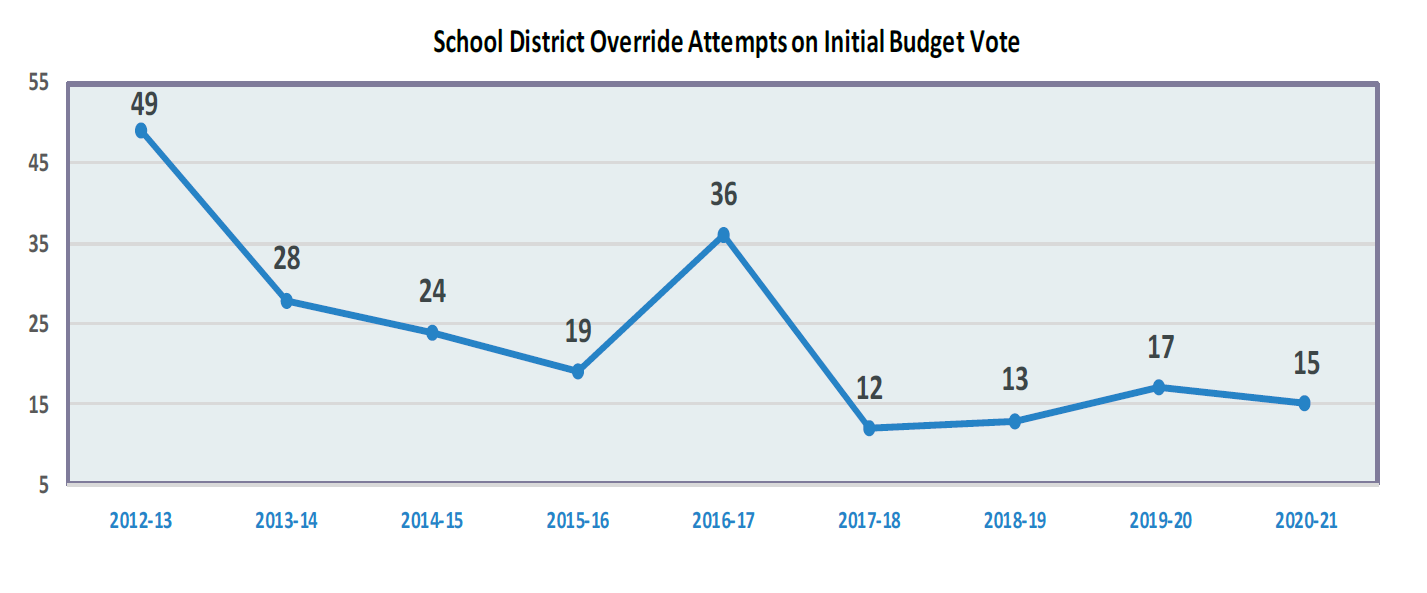

School districts also reported information associated with the calculation of their property tax levy cap. Statewide, there

are 15 school districts that are proposing a 2020-21 property tax levy that exceeds their maximum tax levy limit,

meaning these districts must get at least 60 percent voter approval for their budget to be adopted.1

The full data set is available on SED’s website at:

http://www.p12.nysed.gov/mgtserv/propertytax/docs/2020-21-ptrc-sams-data.xlsx

The reserve fund data is available at:

http://www.p12.nysed.gov/mgtserv/propertytax/docs/2020-21-ptrc-reserve-funds.xlsx

Spending

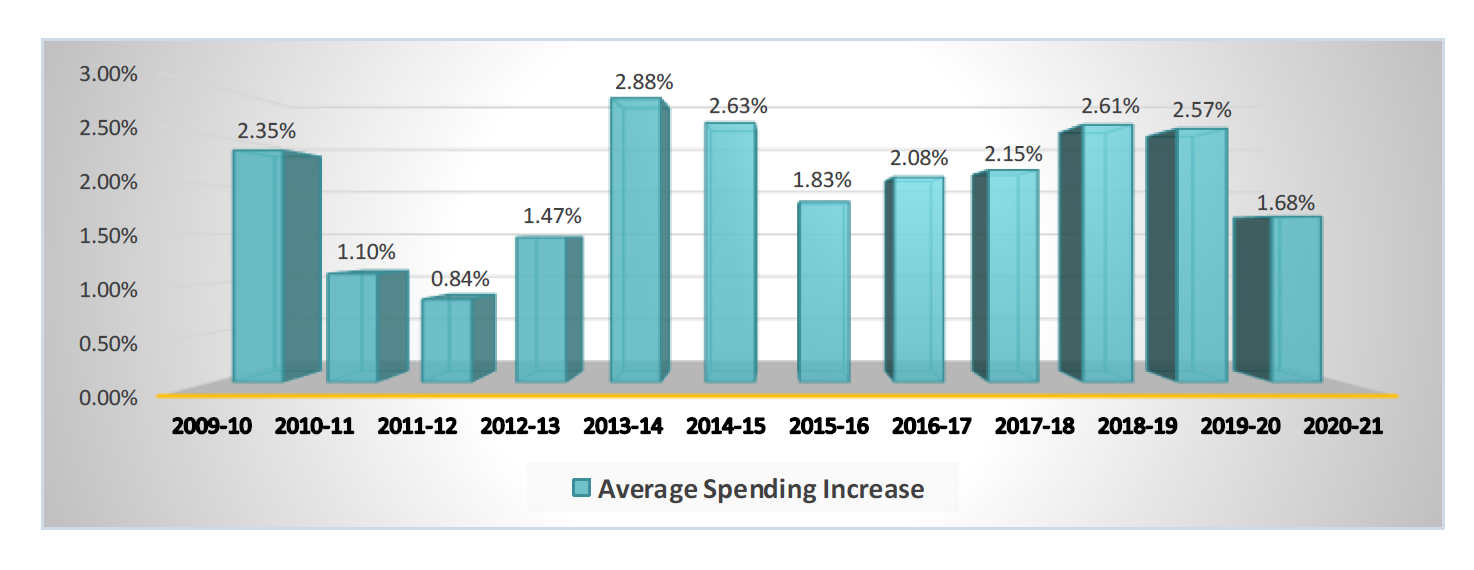

According to the data contained in the 653 Property Tax Report Cards, school districts on average are proposing

budgets for 2020-21 that contain a spending increase of 1.68 percent. Last year the average statewide spending increase

that districts presented in their 2019-20 school budgets was 2.57 percent. The following chart provides a recent history

of the statewide average spending increases.

Taxes

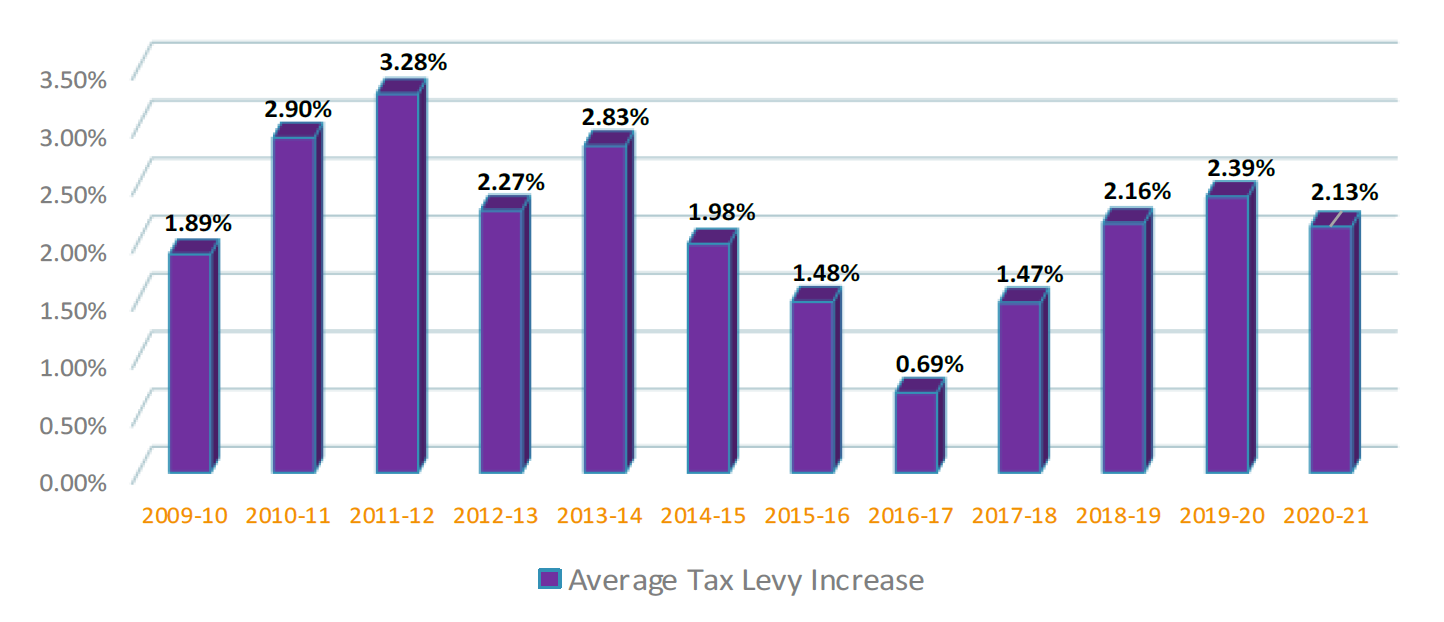

The Property Tax Report Cards also reveal that the average tax levy increase contained in the proposed 2020-21 school

budgets is 2.13 percent. Last year the average statewide tax levy increase was 2.39 percent. The following chart

provides a recent history of the statewide average tax levy increases.

(1) The 15 districts are: Alexandria, Arkport, Central Valley, Dolgeville, Dover, Fort Edward, Johnstown City, Naples,

Northern Adirondack, Northville, Rensselaer, Sherburne-Earlville, Victor, Wainscott, and Wyandanch.

BKB/vp

Cwa1141