As required by law, each year, prior to the school budget vote, all districts must submit a Property Tax Report Card to the New York State Education Department (SED). The data contained in the 2025-26 Property Tax Report Card compares the 2024-25 school budget with the 2025-26 proposed school budget and the 2024-25 tax levy with the 2025-26 projected tax levy. This year voting will take place on May 20, 2025.

In total, 667 school districts submitted their 2025-26 Property Tax Report Card. The Big Five City school districts are not covered by this requirement as the residents in these districts do not vote on their school budget.

In addition to the spending and tax levy increases, districts are also required to report the three parts of the fund balance

on the Property Tax Report Card: (1) the amount and percent of the unrestricted fund balance, (2) the restricted fund

balance and (3) the appropriated fund balance. Although the unrestricted fund balance is limited by law to no more

than 4 percent, 176 school districts reported that they estimate that they will have a fund balance over that legal limit at

the beginning of the 2025-26 school year. In addition, 357 school districts reported that they will be right at that 4

percent limit at the beginning of 2025-26.

Districts are also required to submit detailed information about their Restricted Reserve Funds: the name of each reserve

fund, a description of its purpose, the balance as of the close of the third quarter (3/31) of the current fiscal year and a

brief statement explaining any plans for the use of each such reserve fund for the upcoming fiscal year.

School districts also reported information associated with the calculation of their property tax levy cap. Statewide, there

are 40 school districts that are proposing a 2025-26 property tax levy that exceeds their maximum tax levy limit, meaning

these districts must get at least 60 percent voter approval for their budget to be adopted.1

Spending

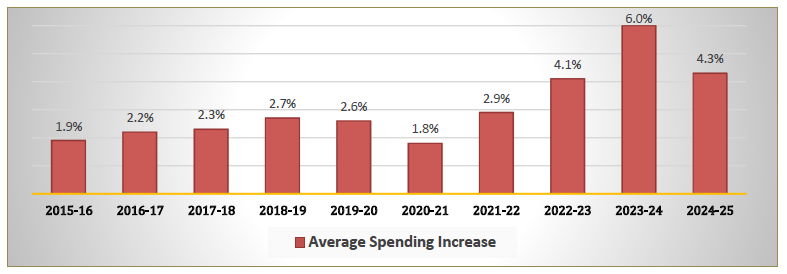

According to the data contained in the Property Tax Report Cards, school districts on average are proposing budgets

for 2025-26 that contain a spending increase of 3.9 percent. Last year, the average statewide spending increase that

districts presented in their 2024-25 school budgets was 4.3 percent. The following chart provides a recent history of

the statewide average spending increases.

Taxes

The Property Tax Report Cards also reveal that the average tax levy increase contained in the proposed 2025-26 school

budgets is 2.6 percent. Last year the average statewide tax levy increase was also 2.6 percent. The following chart

provides a recent history of the statewide average tax levy increases.

The full data set is available on SED’s website at: https://www.p12.nysed.gov/mgtserv/propertytax/

(1) The 40 districts are: Beaver River, Belleville-Henderson, Berlin, Bradford, Brookhaven-Comsewogue, Brunswick,

Canaseraga, Cazenovia, Corning, Cortland, East Greenbush, Ellicottville, Elwood, Fabius-Pompey, Frankfort-

Schuyler, Franklin, Gananda, Hamilton, Harrisville, Hicksville, Horseheads, Indian Lake, Mamaroneck, Moriah, New

Lebanon, New Rochelle, Northville, Oakfield-Alabama, Pearl River, Prattsburgh, Schroon Lake, Scotia-Glenville,

Shelter Island, Sherrill, South Kortright, Southern Cayuga, Southwestern, Thousand Islands, Walton, Waverly.

TM/vp

Cwa1141