Download Fact Sheet (pdf)

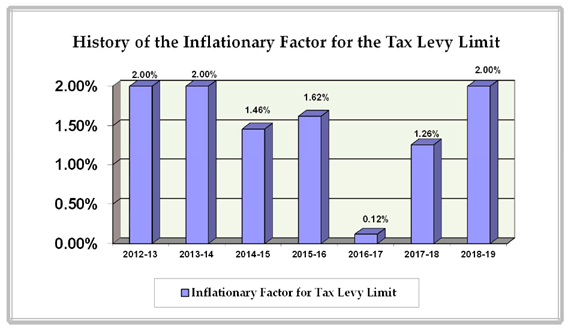

The Bureau of Labor Statistics recently announced that the 2017 calendar year average increase in the CPI was 2.13 percent. This is important because under the tax cap law, allowable increases in the property tax levy limit are based on either 2 percent or the rate of inflation, whichever is less. Therefore, districts will use a 2.00 percent inflation factor when they are calculating their tax levy limit for the 2018-19 school year.

The last time the inflation factor for the property tax levy limit reached the 2.00 percent maximum was back in the 2013-14 school year (see chart for a history of the inflationary factor).

Chapter 97 of the Laws of 2011 enacted the Tax Levy Limit, which is more commonly referred to as the “tax cap.” The basic premise of the law is that school districts are prohibited from adopting a budget that requires a tax levy increase that exceeds the prior year’s levy by more than 2 percent or the rate of inflation, whichever is less, unless the voters override the tax levy limitation, with a 60 percent super-majority approval.

There are various exclusions and adjustments to the tax levy limit calculation. Districts must complete a nine-step formula to calculate their tax levy limit and submit this data to the NYS Office of the State Comptroller by March 1st.

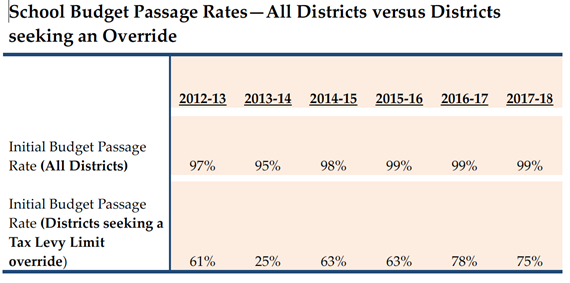

School districts that present a budget that stays within the Tax Levy Limit only need a simple majority of the vote for approval. School districts that fail to gain voter approval of a budget are not able to increase the tax levy above the previous year’s level—a 0 percent cap.

Although school districts in recent years have had tremendous success in budget passage rates—for the last three years the budget passage rate has been 99 percent, school districts have had a more difficult time in overriding the Tax Levy Limit and achieving the 60 percent super-majority approval (see table for a comparison of budget passage rates).